How Can We Help?

How to enter a dependent that lives in Mexico or Canada

How to enter a dependent that lives in Mexico or Canada

SUMMARY

This article demonstrates how to enter a dependent that lives in Mexico or Canada.

MORE INFORMATION

Dependents that live in Mexico or Canada have special IRS treatment. In order for Simple Tax 1040 to correctly calculate the tax return they must be entered with a special code.

To enter a child as a dependent that lives in Mexico or Canada, follow these steps:

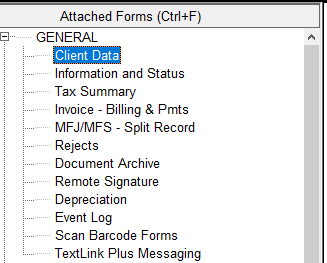

- Click Client Data on the forms attached navigation pane.

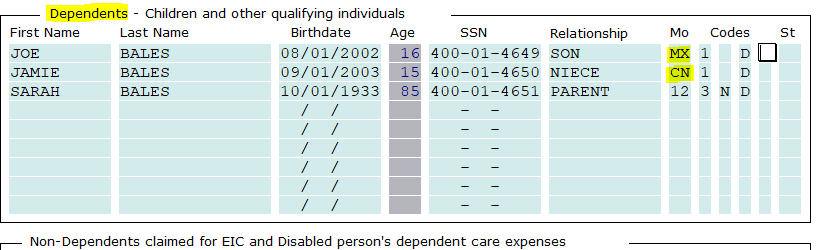

- In the Dependents section, enter the child’s first name, last name, birth date, SSN/ITIN and relationship.

- In the Number of Months Dependent Lived With Taxpayer box, type MX for Mexico or CN for Canada.