How Can We Help?

How to pay a balance due on a an electronically filed tax return

How to pay a balance due on a an electronically filed tax return

SUMMARY

This article explains how to pay the balance due on an electronically filed tax return.

MORE INFORMATION

IRS e-file offers the electronic payment option of electronic funds withdrawal (EFW) to pay the current year balance due. If filing before the tax deadline, you can schedule the payment to occur on a future date up to April 15, 2020. The IRS will debit the checking or savings account for the amount due on the date the payment is scheduled.

Note You cannot use this form after April, 15.

To pay a balance due with Electronic Funds Withdrawal in Simple TAX 1040

- Click Add Form on the tax return toolbar.

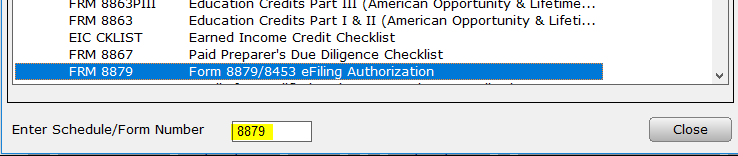

- In the Enter Schedule/Form Number box, type 8879. When you see FRM 8879 in the list, double-click it and Simple Tax 1040 adds the form to the return.

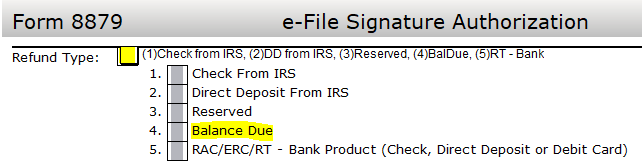

- In the Refund Type box, type 4 to specify a balance due.

- Click Add Form on the tax return toolbar.

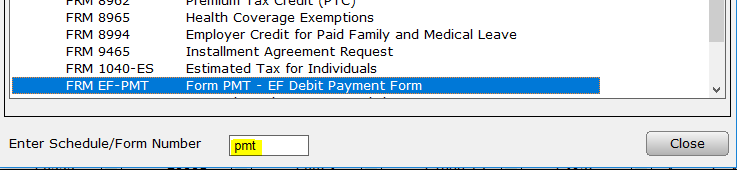

- In the Enter Schedule/Form Number box, type PMT. When you see FRM EF-PMT in the list, double-click it and Simple Tax 1040 adds the form to the return.

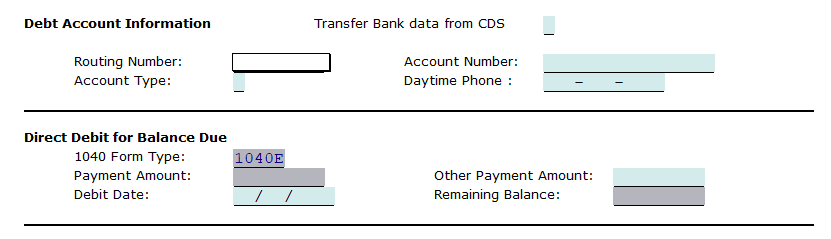

- In the Routing Number box, type the routing number.

- In the Account Number box, type the account number.

- In the Account Type box, type 1 for Checking or 2 for Savings.

- The Debit Date should be at least 2 weeks from the current date so that the IRS has time to Acknowledge the return and take the payment.

- Transmit the tax return to the IRS.