Form 5405 is not attaching to the return

The Form 5405 DOES NOT attach to the return. As you fill out the for 5405 it will calculate the information and present it on SCH 2 line 7b.

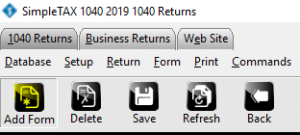

- Click Add Form

- Add Form 5405

![]()

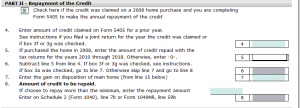

- Make sure to check the box in Part 2 that states “Check here if the credit as claimed on a 2008 home purchase and you are completing Form 5405 to make the annual repayment of the credit”.

![]()

- Make sure to fill out Part 2 of Form 5405.

- Once you complete the Form 5405, it will calculate the Repayment of the first-time homebuyer credit on line 7b of SCH 2.

Form 5405, First-Time Homebuyer Credit, does not appear in the Add Form window

Form 5405, First-Time Homebuyer Credit, does not appear in the Add Form window

SYMPTOMS

When you try to add Form 5405, First-Time Home-buyer Credit, to a return, it does not appear in the list of available forms.

CAUSE

This issue can occur if your software is not up to date.

RESOLUTION

Update Simple Tax 1040

If using an older version of Simple Tax 1040, try updating the software. You can update the software, by following the following steps:

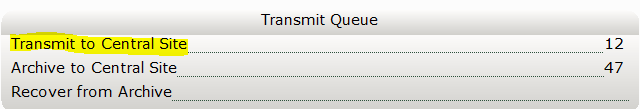

- In Simple Tax 1040, click Transmit to Central Site on the Work In Progress screen.

- On the Transmit to Central Site dialog, click Transmit.

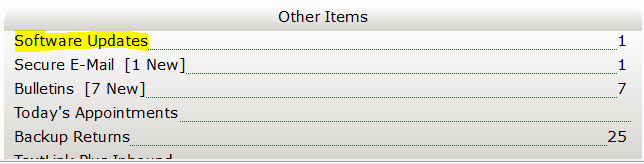

- When the transmission is complete, click Software Updates on the Work in Progress screen. If the link for Software Updates is unavailable, no updates are available for install and Simple Tax 1040 is up to date with the features and tax law changes.

- Click Apply All and Simple Tax 1040 installs all available updates.

![]()