Form 5405, First-Time Homebuyer Credit, does not appear in the Add Form window

Form 5405, First-Time Homebuyer Credit, does not appear in the Add Form window

SYMPTOMS

When you try to add Form 5405, First-Time Home-buyer Credit, to a return, it does not appear in the list of available forms.

CAUSE

This issue can occur if your software is not up to date.

RESOLUTION

Update Simple Tax 1040

If using an older version of Simple Tax 1040, try updating the software. You can update the software, by following the following steps:

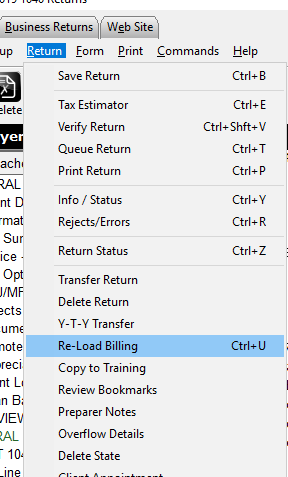

- In Simple Tax 1040, click Transmit to Central Site on the Work In Progress screen.

- On the Transmit to Central Site dialog, click Transmit.

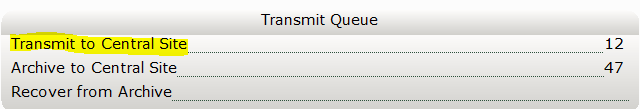

- When the transmission is complete, click Software Updates on the Work in Progress screen. If the link for Software Updates is unavailable, no updates are available for install and Simple Tax 1040 is up to date with the features and tax law changes.

- Click Apply All and Simple Tax 1040 installs all available updates.

![]()

An updated amount in the billing schedule does not appear on the invoice in a tax return

SYMPTOMS

When you update the amount you want to charge for the 1040, 1040A, or 1040EZ, the new billing amount does not appear on the Billing and Invoice screen.

CAUSE

This issue occurs because Simple Tax 1040 requires you to delete the form to update the fee.

RESOLUTION

Reload the billing scheme (2010 and above)

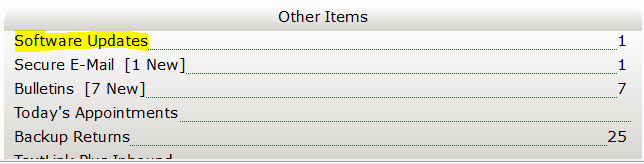

- Open the applicable tax return.

- On the Return menu, click Re-Load Billing.