How to back up your Simple Tax 1040 update files

How to back up your Simple Tax 1040 update files

SUMMARY

This article demonstrates how to backup your update files.

MORE INFORMATION

To perform a backup of the update files, follow these steps.

RESOLUTION

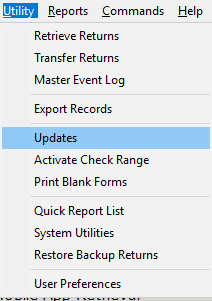

- On the Utility menu, click Updates.

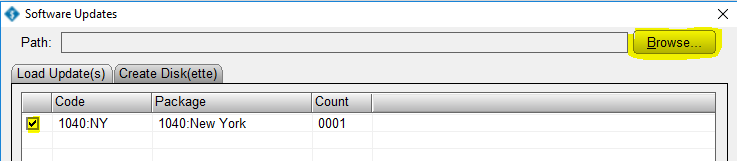

- Select the updates you want to back up and then click Browse.

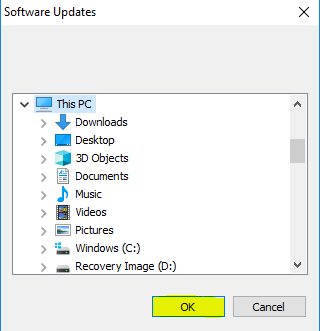

- Click a drive and then click OK. You cannot back up updates to a sub folder of a drive. Select only a drive letter – for example, Local Disk C:.

- Click Create.

How to backup and restore all SimpleTAX 1040 data

How to backup and restore all SimpleTAX 1040 data

SUMMARY

This article provides information on how to back up and restore all data in SimpleTAX 1040.

MORE INFORMATION

The easiest way to backup SimpleTAX 1040 is to back up the applicable XLink folder.

How to back up all SimpleTAX 1040 data

- Insert a removable media into your computer – for example, a flash drive, thumb drive, etc.

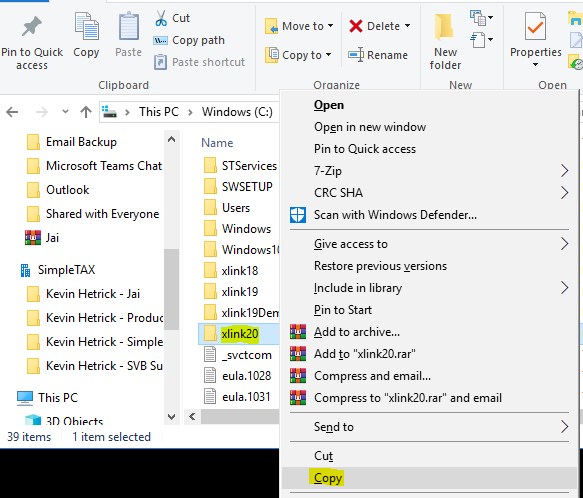

- In My Computer, browse to the drive where you installed the SimpleTAX 1040 program you want to backup.

- Right-click the XlinkYY folder, where YY is the last two digits of the year of SimpleTAX 1040 you want to backup, and then click Copy.

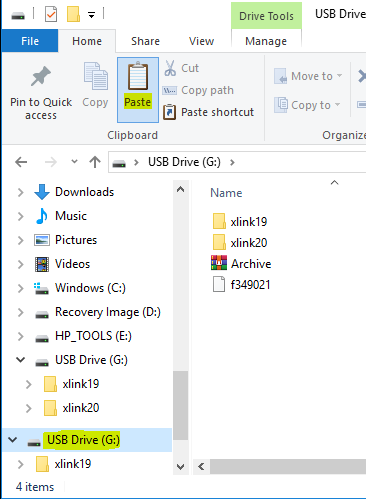

- In Windows Explorer, browse to the removable media drive and then click Paste on the Edit menu.

How to restore all SimpleTAX 1040 data

- Install SimpleTAX 1040 on the computer where you want to restore the SimpleTAX 1040 data.

- Insert the removable media into your computer.

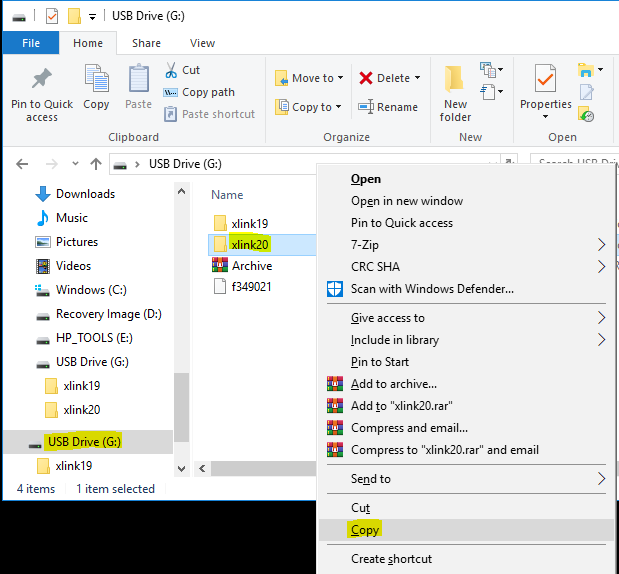

- In My Computer, browse to the removable media drive.

- Right-click the applicable Xlink data folder and then click Copy.

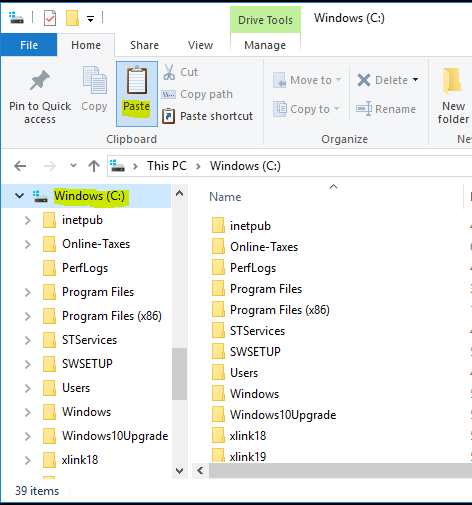

- Browse to the drive where you want to restore Simple Tax 1040.

- On the Edit menu in Windows Explorer, click Paste.

How to use the Backup Returns feature in SimpleTAX 1040

How to use the Backup Returns feature in SimpleTAX 1040

SUMMARY

This article demonstrates how to use the Backup Returns feature in SimpleTAX 1040.

MORE INFORMATION

As anyone who has lost their data can recount, backing up return data is essential during the tax season. We recommend you make backing up your data a daily routine during tax season.

To back up your returns using the Backup Returns feature, follow these steps:

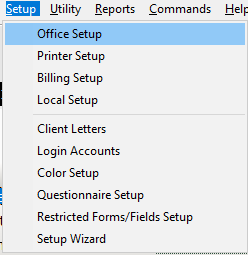

- Click the Setup menu and then click Office Setup. The SimpleTAX 1040 Settings window will display.

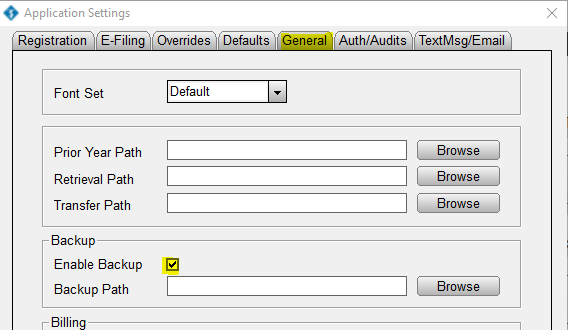

- Click the General tab and then select the Enable Backup option that appears in the Backup section.

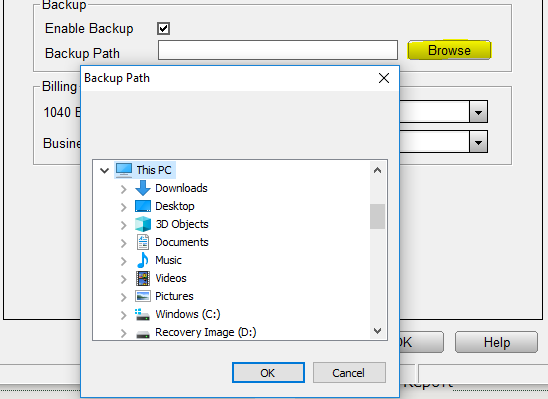

- Click the Browse button that appears in the Backup Path to choose a path for your backed up data. If you do not specify a Backup Path and click OK,

NOTE: SimpleTAX 1040 will place the backup file in the XLINK folder. We recommend storing backup files off-site, for example, on a USB drive that you take home daily.

- Click OK to return to the Work in Progress screen.

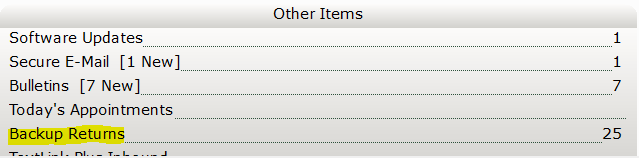

- Once on the Work in Progress screen, click the Backup Returns option.

Note: If you do not see a Backup Returns option in the Work in Progress screen, press F2 on your keyboard to refresh the screen.

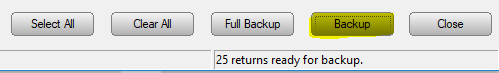

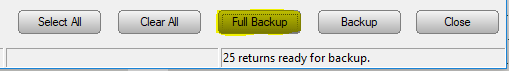

- In the Backup Returns window, select the returns you want to backup, or click the Select All button to backup all your returns.

- If you click the Full Backup button, the program will also allow you to back up additional information, such as PDF Documents, Database Records, Check Records, Billing Schedules, Client Letters, and Save queue.

- Once you have selected all the information you want to backup, click the Backup button to begin the backup progress.