Setting up Direct Input or Interview Input in KIS Desktop

The objective of this article is to walk you through on how to set up Direct Input or Interview Input.

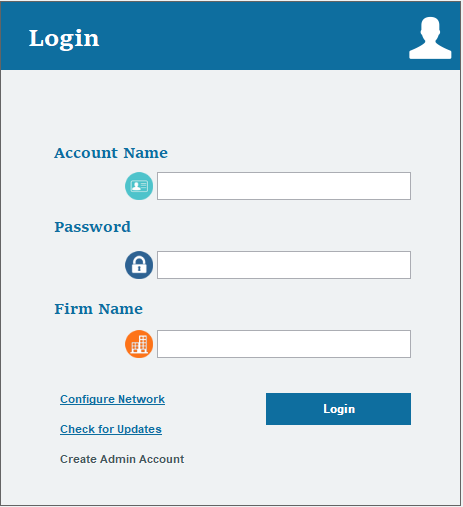

- Login to your Keep It Simple Desktop software

- Click on the SETUP tab at the top right corner

- Click on the Settings icon on the left side of the screen, it is the third icon from the top

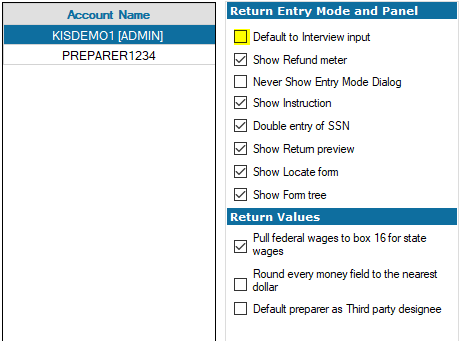

- Under PREPARER/CLIENT LEVEL SETTINGS you will see where it says Return Entry Mode. From there select if you want Default to Interview Input where you will answer questions to enter the information on the return, otherwise it will be set to Default to Direct Input where you will enter everything directly into the forms.

- Click the blue button at the bottom of the screen that is labelled SAVE.

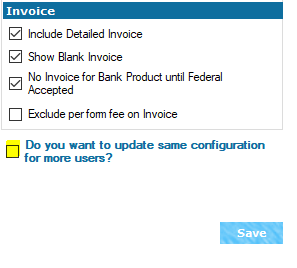

- You can set each preparer separately, HOWEVER, if you want all preparers under the same input you can scroll down to the bottom of the page and check the box next to “Do you want to update the same configuration for more users?” Click SAVE.

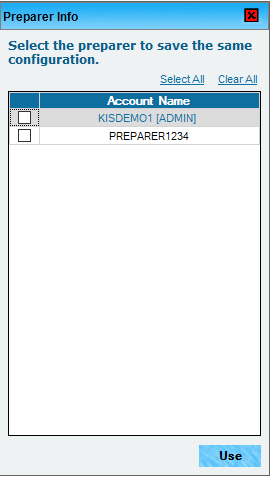

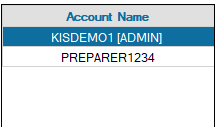

- Then select the preparers you want to update with the same configurations by checking the box next to each preparer name at the top of the screen under ACCOUNT NAME and click USE

- If you wish to set each preparer differently then DO NOT check the box to update the same configuration for more users and instead click the blue button labelled SAVE, and click on the next Account Name you which to edit the input type

Login refused – serial changed” error message when transmitting to Central Site

Login refused – serial changed” error message when transmitting to Central Site

SYMPTOMS

When you transmit to Central Site, the following error message appears:

‘Login Refused Serial Changed’

CAUSE

You may receive this error message if any of the following conditions are true:

- Another computer has already transmitted to Central Site using the specified User ID.

- You are transmitting from a newly purchased computer.

RESOLUTION

When you transmit, Central Site assigns each transmitting computer a unique serial number. Central Site uses this serial number to prevent multiple stand-alone computers from transmitting to Central Site with the same User ID. If a user attempts to transmit to Central Site with multiple stand-alone computers using the same User ID, the message Login Refused Serial Changed appears.

There are circumstances in which users may want to transmit to Central Site with multiple stand-alone computers using the same User ID – for example, the customer purchased a new computer. You can use Reset Serial Number to workaround this issue.

Method 1: Verify the User ID

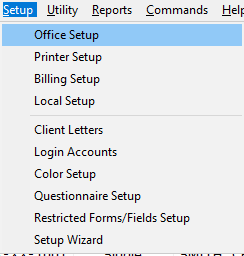

- On the Setup menu, click Office Setup.

- Verify the correct User ID appears in the User ID box. If the correct ID does not appear, type the correct one.

Method 2: Contact SimpleTAX support to reset the computer’s serial number

- Please call (281) 833-9300, Option 2.

How to change the primary taxpayer Social Security number in a tax return

How to change the primary taxpayer Social Security number in a tax return

SUMMARY

This article demonstrates how to change the primary taxpayer Social Security number (SSN) in a tax return.

MORE INFORMATION

After electronically filing a tax return to the IRS, the IRS may reject a tax return for code 315 – The primary taxpayer’s SSN and primary taxpayer’s last name must match data from the IRS Database. This rejection means that either the taxpayer’s name or Social Security Number does not match the information that the IRS has on file. If you determine that you have incorrectly entered the primary taxpayer’s Social Security Number, you can easily change it in Simple Tax 1040.

To change a primary taxpayer’s Social Security Number, follow these steps:

- Open the return with the Social Security number you want to change.

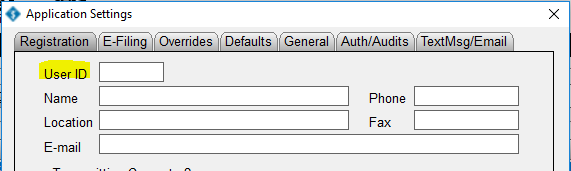

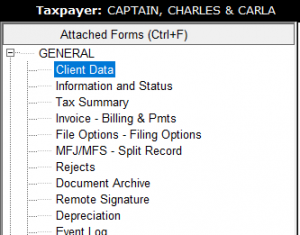

- On the attached forms navigation pane, double-click Client Data.

- In the SSN box under Taxpayer Information, type the new Social Security number.

![]()

- Click Refresh and Simple Tax 1040 changes the Social Security Number on all underlying forms and worksheets.

Important: If the taxpayer is applying for Bank Product, it will be necessary to delete the current Form 8879 and add a new one. Continue to step 5 if the taxpayer is applying for a Bank Product. If the taxpayer is NOT applying for a Bank Product, ignore the steps below.

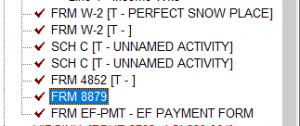

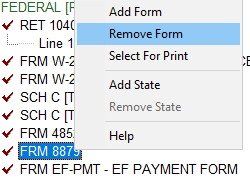

- In the attached forms navigation page, double-click Form 8879 and then click Remove Form.

- Click OK to confirm the deletion.

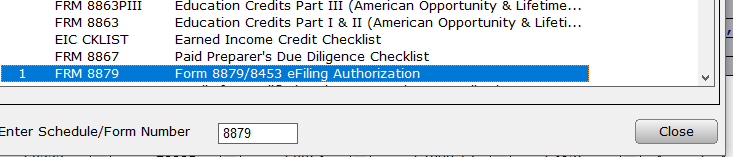

- Click Add Form and add Form 8879 from the list of available forms. Enter any applicable information that needs to be included in the form.

How to add a change a user’s password to login to Simple Tax 1040

SUMMARY

This article demonstrates how to add or change a user’s password.

MORE INFORMATION

13 STEPS

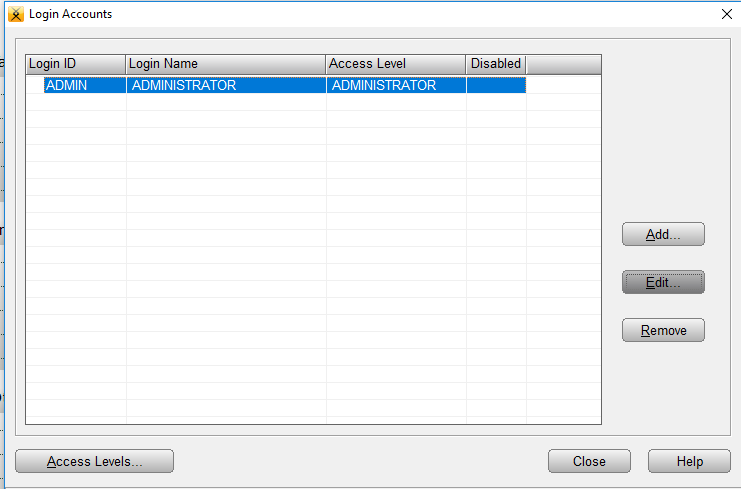

1. Click Logins

2. Click Add...

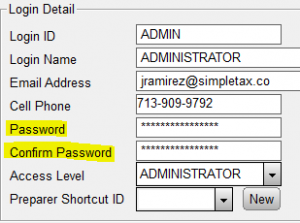

3. Enter a Login ID

That will be what they use as their login.

4. Enter a Login Name

5. Enter an Email Address

That is the email they will use if they ever need to reset your login password.

6. Enter a Cell Phone Number

That is the email they will use if they ever need to reset your login password.

7. Enter a Password

8. Re-enter your password to Confirm Password

9. Select the Access Level from the drop down list that you want this login to have.

10. Select the Preparer Shortcut from the drop box list to link the Login with the Preparer.

11. Click OK

12. You can Edit or Remove a Login by highlighting the login account name and then clicking on either Edit or Remove.

13. Click Close You are Done!

Here's an interactive tutorial

https://www.iorad.com/player/1691471/Software-Setup-Wizard-for-Logins

Simple Tax 1040

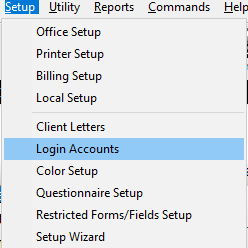

- On the Setup menu, click Login Accounts.

- Click the user you want to modify and then click Edit.

- In the Password box, type the new password and retype the same password in the Confirm Password box.

- Click OK.