MyTaxOffice Mobile App Setup for Preparers

MyTaxOffice Mobile App setup for Preparers

To be able to setup your software with your customer’s MyTaxOffice Mobile App you will need to follow the steps below.

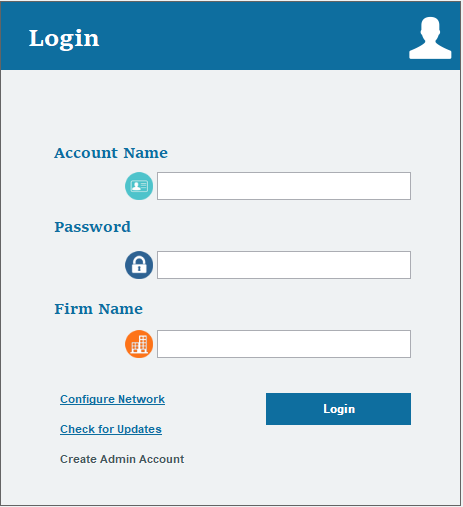

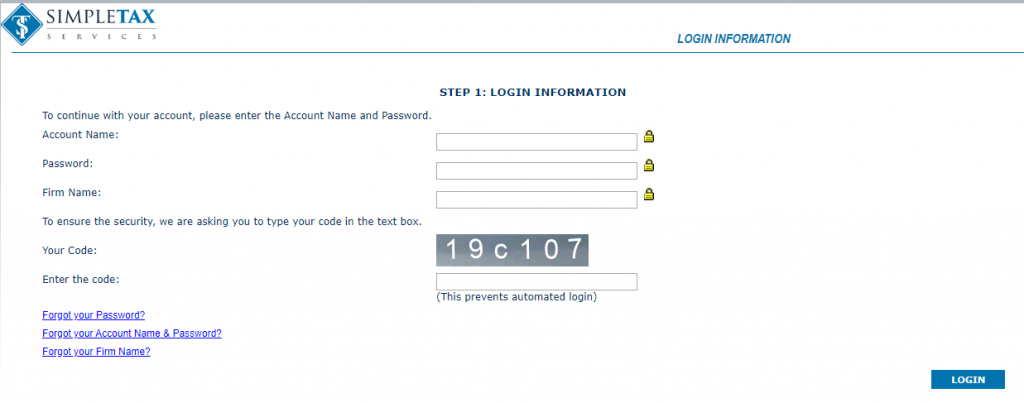

- Login to KIS Online/Desktop

- Click on the Setup

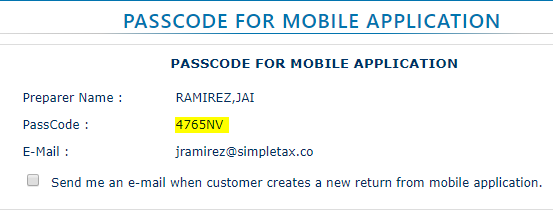

- You will automatically be directed to the Preparer Information screen, click on the icon that looks like two squares at the far right of the Preparer Name.

- You will then get the PassCode on the screen and give to your customers. They will need this PassCode to setup their MyTaxOffice Mobile App so that the information is sent to you directly.

- Note: Each preparer has their own PassCode to use with their customers unless you want all returns to go to the administrator then use the administrator’s PassCode ONLY.

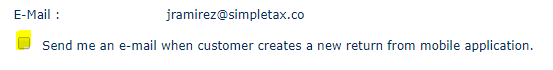

- You can check the box “Send me an email when customer creates a new return from the mobile application” if you want to get email notifications when your customers create a new return through the MyTaxOffice Mobile App. It will send to the email under the PassCode.

- NOTE: If you wish to change the email, you can do so in the Preparer Information screen by clicking on the edit icon that looks like a pencil inside a box.

How to find the reason that the IRS or state rejected a tax return

How to find the reason that the IRS or state rejected a tax return

SUMMARY

This article demonstrates how to look up the reason the IRS or state rejected a tax return.

MORE INFORMATION

To find the reason the IRS or state rejected a tax return, follow these steps:

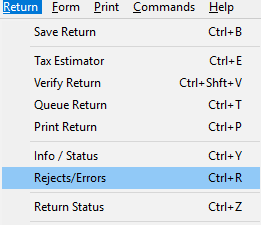

- From within the tax return experiencing the issue, click Return at the top of Menu and then click Rejects/Errors.

- NOTE: The rejection appears on your screen. If no rejects appear, try pressing Ctrl + R.

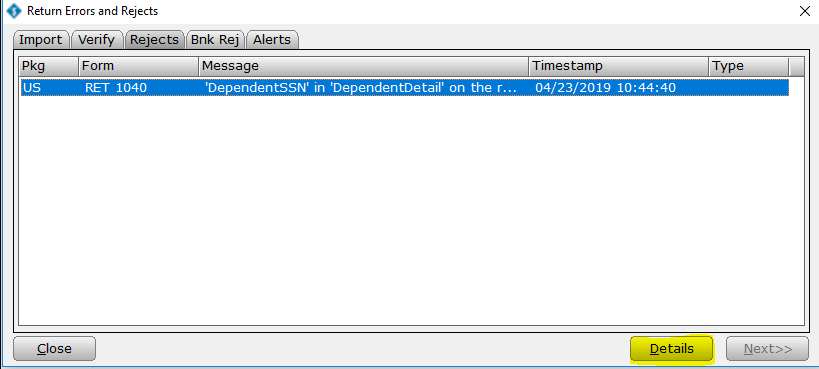

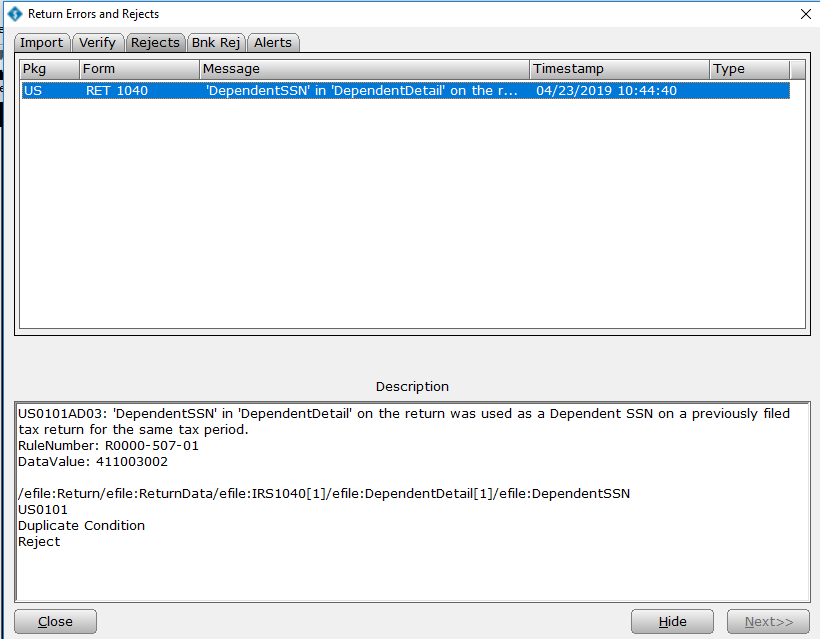

- Once the list of rejections appears on your screen, click the desired rejection to highlight it blue, and then press the Details button to display more information about that specific rejection

- If you want Simple Tax 1040 to take you to the form and field containing the error, simply double-click the reject error.