Errores de Database cuando abre el programa

l objetivo de este articulo es para mostrar los paso que hacer cuando recibe un Error del Database en el programa de KIS Desktop.

Llame al Departamento de Asistencia Tecnico de Simple TAX para asistencia al 281-833-9300 opxion 2 para Asistencia.

Agregando su EIN en el Database

El objetivo de este articulo es para mostrar como agregar su EIN(Employer Identification Number) a el Database.

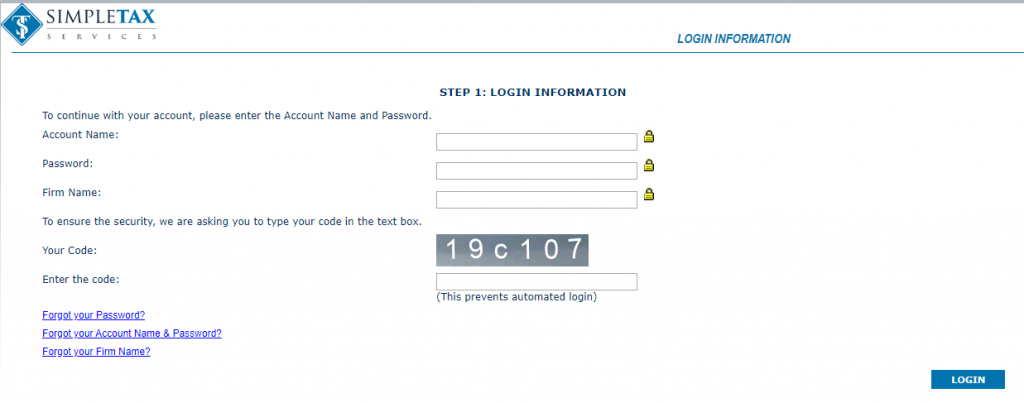

- Abra su programa Keep It Simple Online e ingresese.

- Haga clic en SETUP ubicado en la esquina derecha.

- Haga clic en el icono de EIN DATABASE ubicado a la izquierda.

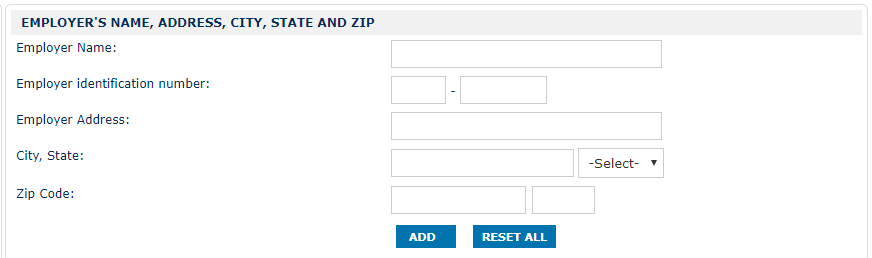

- Llene la informacion incluyendo su Nombre de Empleado (Employer Name), EIN y Direccion (Address).

- Haga clic el boton azul con la etiqueta ADD.

Adding EIN to Database

The objective of this article is to walk you through on how to add EIN (Employer Identification Number) to Database.

- Login to your Keep It Simple Online software.

- Click on the SETUP tab at the top right corner.

- Click on the EIN DATABASE icon on the left side of the screen.

- Fill out the information including Employer Name, EIN and Address.

- Click the blue button labeled ADD.

Database error when opening Desktop software

The objective of this article is to advise you on what to do if you get a Database Error when opening your KIS Desktop Software.

Call Simple TAX Support Department for assistance at 281-833-9300 option 2 for Support.

IRS Rejection: Primary SSN or Primary Name on the return header does not match what is at IRS database.”

CAUSE

The name or SSN entered in the tax return does not match the name or SSN that the IRS has in their database.

RESOLUTION

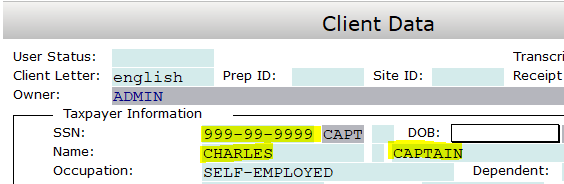

Method 1: Verify that the taxpayer’s name or SSN is correct in the tax return

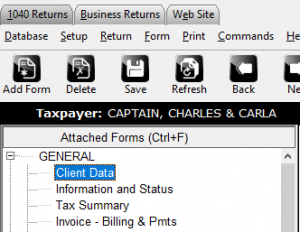

- Open the appropriate tax return and click Client Data on the Forms Attached pane.

- Verify the taxpayer’s name and SSN are correct and matches the information on the taxpayer’s Social Security card.

Method 2: Request the taxpayer contact the IRS

If the information on the tax return matches the taxpayer’s Social Security card, the taxpayer should contact the IRS to confirm that their record at the IRS is correct and up-to-date. You can contact the Social Security Administration.