Como validar su EFIN en Keep It Simple

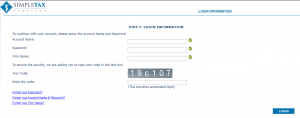

- Ingrese al programa de Keep It Simple Online

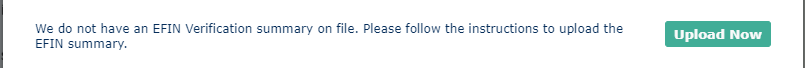

- En el mensaje de EFIN Notification, haga clic Upload Now.

![]()

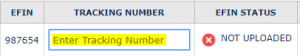

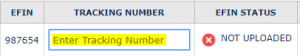

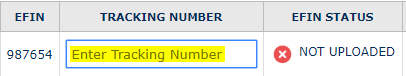

- En la siguiente pantalla, ingrese el IRS Tracking Number adentro de la cajilla de Tracking Number.

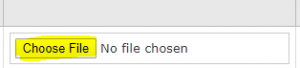

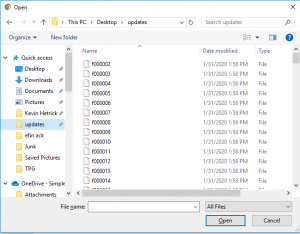

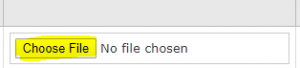

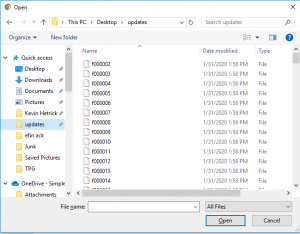

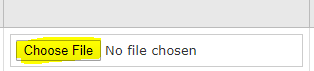

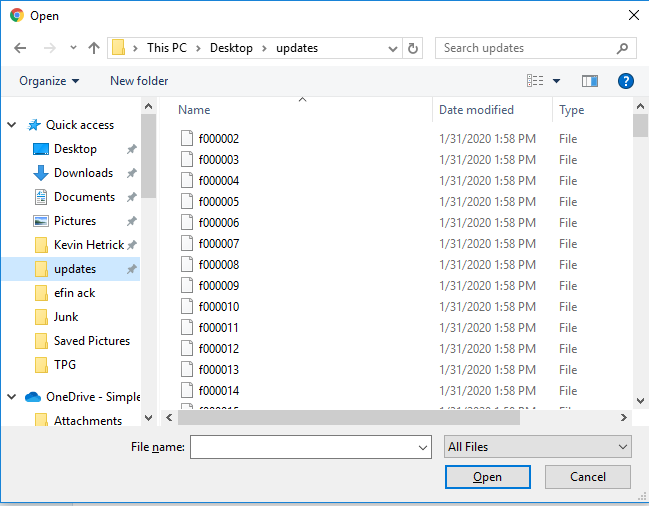

- Haga clic Choose File.

- Seleccione su copy del IRS EFIN Status Summary Page en forma de pdf.

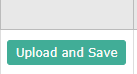

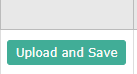

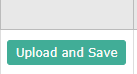

- Luego haga clic Upload and Save.

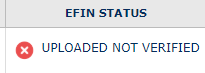

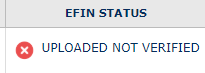

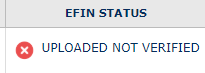

- Usted puede ver el estado de su validacion debajo de EFIN STATUS.

El estado permanecera en UPLOADED NOT VERIFIED hasta que el IRS verifique la informacion del EFIN. No hay un periodo de tiempo exacto que el IRS tenga para hacerlo. Sin embargo, esto no evita su abilidad de procesar declaraciones de impuestos.

Como validar su EFIN en el programa de Keep It Simple

Como validar su EFIN en el programa de Keep It Simple

- Ingresese al programa de Keep It Simple Online

- En la notificacion del EFIN, haga clic Upload Now.

![]()

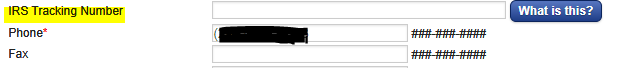

- En la siguiente pantalla, ingrese el IRS Tracking Number adentro de la cajilla etiquetada Tracking Number.

- Haga clic Choose File.

- Selecione su copia en PDF de el IRS EFIN Status Summary Page.

- Despues haga clic Upload and Save.

- Entonces podra ver el estatus de su validacion debajo de EFIN STATUS.

Este estatus permanecera UPLOADED NOT VERIFIED hasta que el IRS verifique la informacion del EFIN. No hay un tiempo fijo en lo que demore para que el IRS verifique la informacion. Sin embargo, esto no afectara su abilidad de mandar declaraciones a el IRS electronicamente.

Adding Firm Information in KIS Desktop

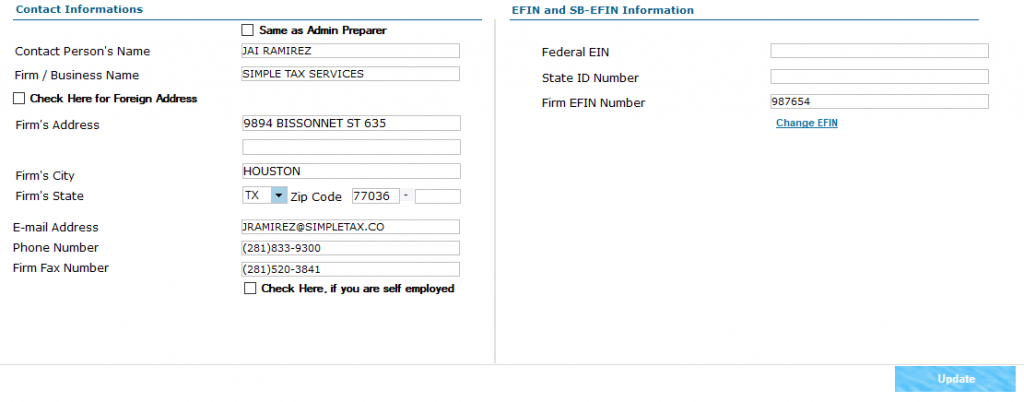

Adding Firm Information

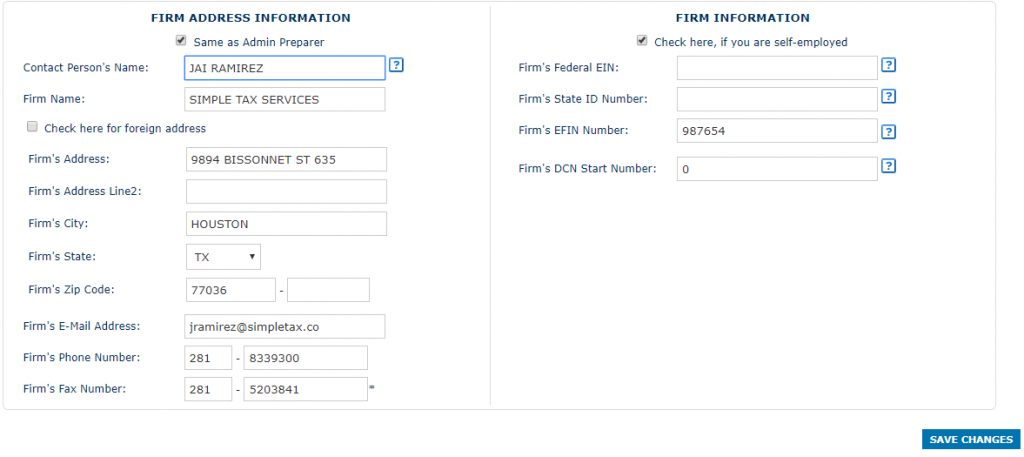

The objective of this article is to walk you through on how to add Firm Information.

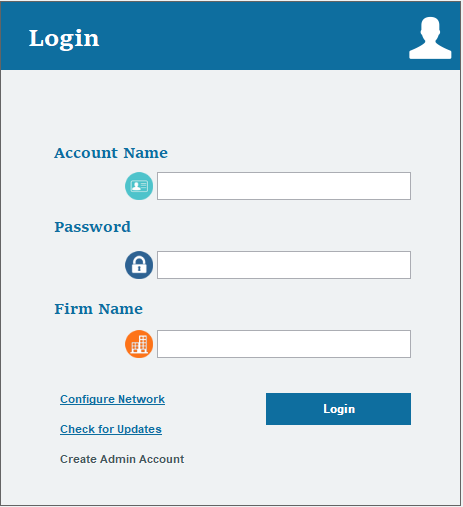

- Login to your Keep It Simple Desktop software.

- Click on the SETUP tab at the top right corner.

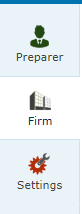

- Click on the FIRM icon on the left side of the screen, it is the second icon from the top.

- Fill out all the information on the screen under FIRM ADDRESS INFORMATION and under FIRM INFORMATION.

- Once you have entered all the information to the best of your knowledge, click on the blue button on the lower right corner labeled UPDATE.

Adding Firm Information in KIS Online

Adding Firm Information

The objective of this article is to walk you through on how to add Firm Information.

- Login to your Keep It Simple Online software.

- Click on the SETUP tab at the top right corner.

- Click on the FIRM icon on the left side of the screen, it is the second icon from the top.

- Fill out all the information on the screen under FIRM ADDRESS INFORMATION and under FIRM INFORMATION.

- Once you have entered all the information to the best of your knowledge, click on the blue button on the lower right corner labeled SAVE CHANGES.

How to validate Your EFIN in Keep It Simple

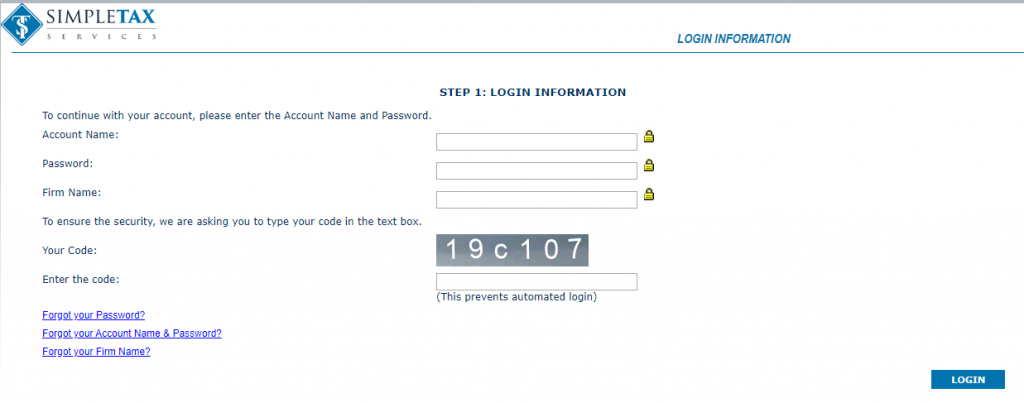

- Log into the Keep It Simple Online

- On the EFIN Notification, Click Upload Now.

- On the next screen, enter the IRS Tracking Number inside the Tracking Number box.

- Click Choose File.

- Select your PDF copy of the IRS EFIN Status Summary Page.

- Then click Upload and Save.

- You can see the status of your validation under EFIN STATUS.

The status remain UPLOADED NOT VERIFIED until the IRS verifies the EFIN information. There is no time frame for the IRS to do this. However, this will not affect your ability to file any returns.

How to locate your IRS Tracking Number from the IRS e-Services

How to locate your IRS Tracking Number from the IRS e-Services

The objective of this article is to walk you through on how to locate your IRS Tracking Number from the IRS e-Services website.

IF YOU ARE UNABLE TO LOG IN TO e-SERVICES, CONTACT THE e-SERVICES HELP DESK AT 1-866-255-0654. THE e-SERVICES CAN PROVIDE YOUR IRS TRACKING NUMBER OVER THE PHONE AFTER IDENTITY VERIFICATION.

- Access the IRS e-Services Account Sign Up and Log In Page. If you do not have an e-services account, click Create Account and follow the on-screen prompts..

- Enter your username and select LOGIN. If you are an existing e-Services user, but have not registered in the new e-services system, you will be prompted to update your registration. Follow the onscreen prompts.

- Enter your password in the space provided and select SUBMIT

- A 6-digit security code will be sent to the phone number you provided when you registered for e-Services. You will be prompted to enter your 6-digit security code in the space provided. Select SUBMIT

- Follow the onscreen prompts by selecting the CONTINUE and/or SUBMIT buttons until you reach the ESAM Application Landing Page

- Locate your Tracking Number (The Tracking Number will contain 16 or 20 digits) in the list of Applications:

If you are required to submit a pdf copy of the application summary to your software for validation

- Click the eyeball icon under the View/Edit column

- At the top of the Application Summary screen, click Print and print to a PDF.

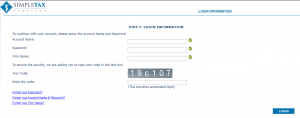

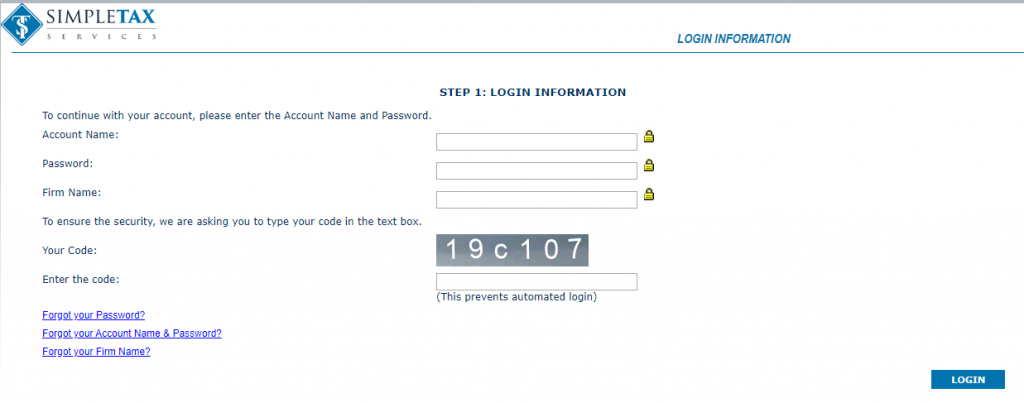

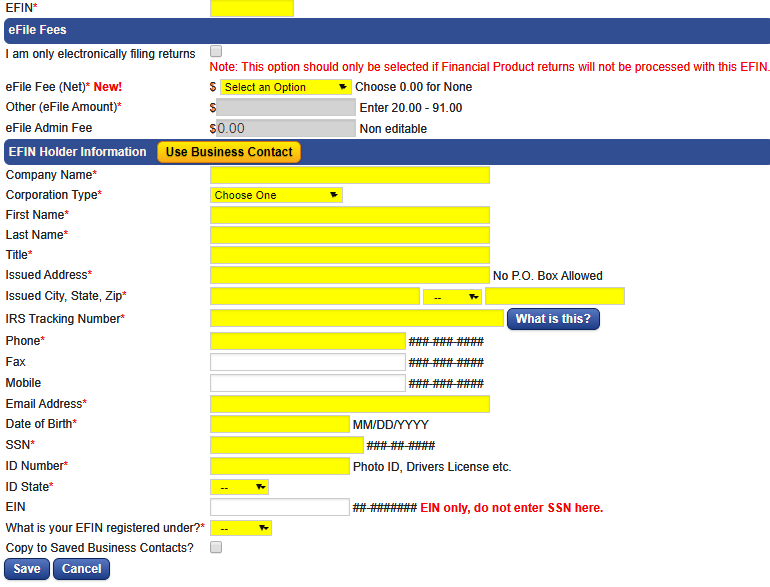

How to validate Your EFIN in SimpleTAX 1040

- Log into the SimpleTAX 1040 Customer Portal at: http://simpletax.mytaxofficeportal.com

- If you are enrolling with a bank. Enter the IRS Tracking Number (Article on How To Locate IRS Tracking Number Here) in the IRS Tracking Number Field and Select What your EFIN is Registered with under with the IRS?

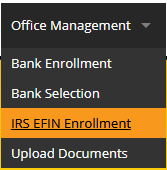

- If you are not enrolling with a bank, IRS EFIN validation is still required. From the Top Menu, select Office Management and click on IRS EFIN Enrollment.

- Click the ADD EFIN button (If your EFIN information already exists, select your existing EFIN)

- Enter your EFIN information making sure to also enter your IRS Tracking Number associated with your EFIN. If this is an existing EFIN for which you have information populated, simply add the IRS Tracking Number and Click SAVE.

- Repeat these steps for additional EFINs.