New Estimator

This article will show you how to do a tax estimate.

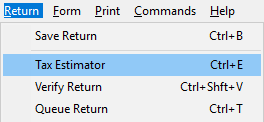

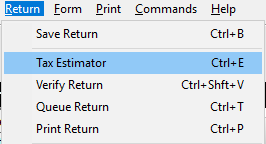

- After you add a new return, click Return and select Tax Estimator.

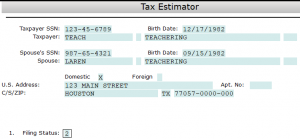

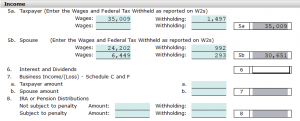

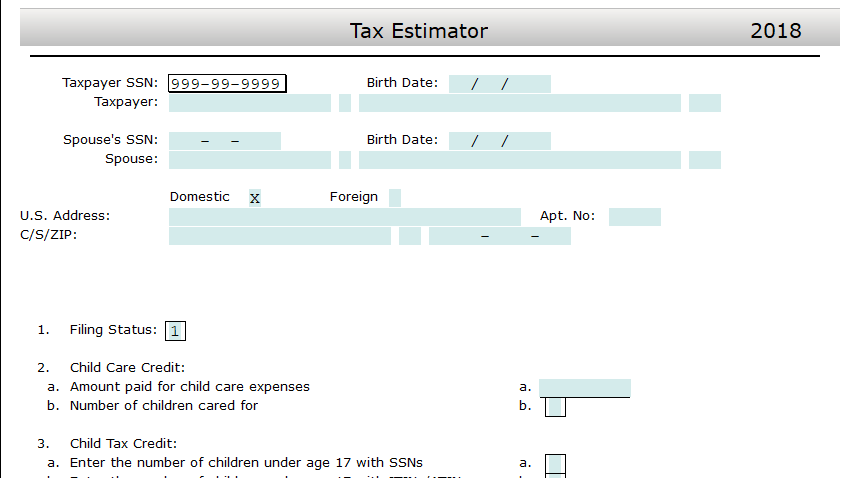

- In the Tax Estimator, fill out as much information as possible to get the best estimate.

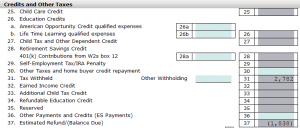

- Under Credit and Other Items you will see Estimated Refund/ (Balance Due) that will show you what the estimated refund or balance due will be based on the information you provided.

How to use Tax Estimator to quickly estimate a taxpayer’s potential refund or taxes owed

How to use Tax Estimator to quickly estimate a taxpayer’s potential refund or taxes owed

SUMMARY

This article demonstrates how to use Tax Estimator to get a quick estimate of a taxpayer’s potential refund.

MORE INFORMATION

To print a Tax Estimator:

- From within a tax return, click Tax Estimator on the Return menu. Simple Tax 1040 takes you to Tax Estimator.

- Complete required information. Simple Tax 1040 estimates the taxpayer’s potential refund.

Note: Simple Tax 1040 will also open the Tax Estimator when you press Ctrl+E on your keyboard.