How to view a list of non-returning customers

How to view a list of non-returning customers

SUMMARY

This article demonstrates how to run a report of customers who have not returned to you for tax preparation services during the current tax year.

MORE INFORMATION

To view a list of non-returning customers, follow these steps:

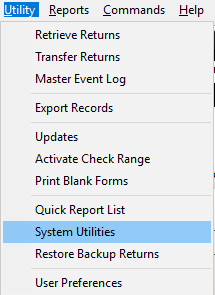

- On the Utilities menu, click System Utilities.

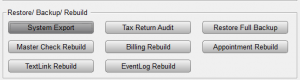

- Click System Export.

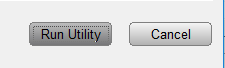

- Click Run Utility.

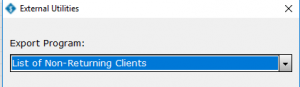

- In the Export Program box, List of Non-Returning Clients will be already selected, if not select it from the drop box.

- In the Output File Name box, type the location and name of the file where you want to save the client list. Specify .csv as the file name extension. Example: c:\non_returning_clients.csv

![]()

- Click Run. The software saves the list of customers to the folder file you specified. You can open the file in Microsoft Excel or any program capable of opening .csv files.

![]()

How to proforma your tax return files

How to proforma your tax return files

SUMMARY

This article demonstrates how to Proforma forward your prior year tax return files.

MORE INFORMATION

26 STEPS

1. Once you login to the software, the Software Setup Wizard will appear. Click Office

2. Click E-Filing

3. Enter yore EFIN in the Default EFIN

4. Click Overrides

5. Enter your Company Name

6. Type in your Company Address

7. Type in the City

8. Type in the State

9. Type in rthe Zip Code

10. Type in Company Phone Number

11. Enter the ERO's Name

12. Enter the Firm Address

13. Enter the City

14. Enter the State

15. Enter the Zip Code

16. Click Defaults

17. Click check box Auto-save return when closed. This will automatically save the return whenever you close the return or software.

18. Click General

19. If you had the same software the previous year, enter the Prior Year Path or click Browse to select if from your PC.

20. Click OK

21. Click Auth/Audits

22. Here you can use each button to configure Diagnostic validation checks if you like to know how check out our Software Setup Wizard for Audit Control video. Click OK to continue.

23. Click TextMsg/Email

24. Enter your Gmail Email Address

25. Enter the Password to the Gmail Email Address above.

26. Click OK

Here's an interactive tutorial

https://www.iorad.com/player/1691107/Software-Setup-Wizard-for-Office-Setup

Method 1: Recommended Method

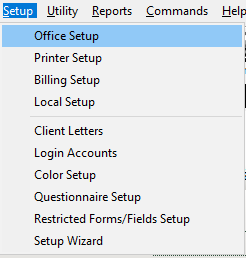

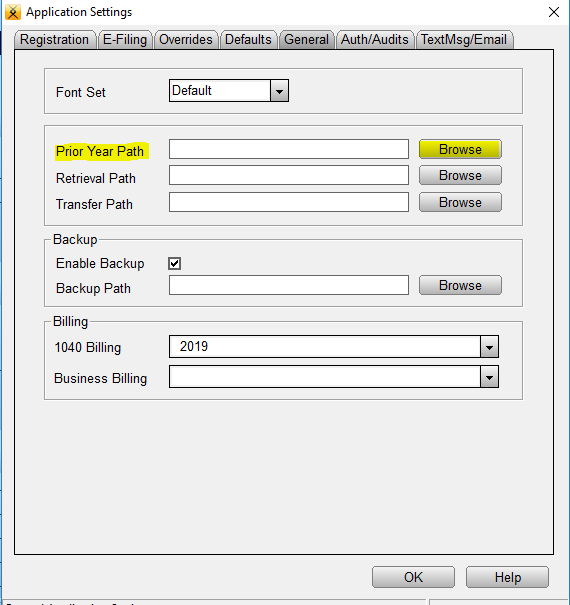

- On the Setup menu, click Office Setup.

- Click the General tab.

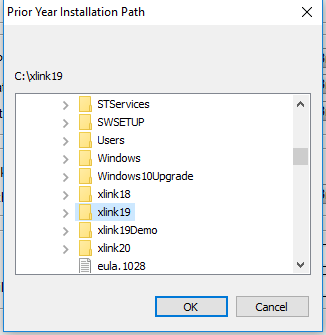

- Click Browse to the right of Prior Year Path. Browse to the folder where you installed the prior year Simple Tax 1040 program and then click OK. For example, to Proforma prior year tax returns into current year software, click the XlinkXX folder. (XX represents the year)

When you begin a new tax return with the same Social Security number of a tax return you prepared last year, Simple Tax 1040 will ask you if you want to bring forward the Proforma information.

Method 2: Not Recommended

Important We do not recommend selecting this method because all Proforma tax returns appear on the Lookup screen.

To Proforma your tax return files, follow these steps:

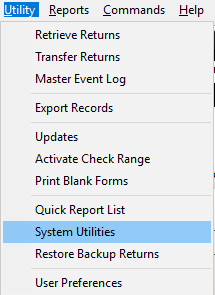

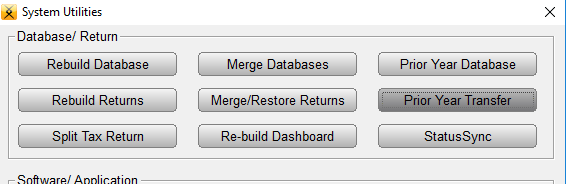

- On the Utility menu, click System Utilities.

- Click Prior Year Transfer.

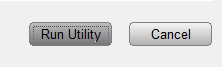

- Click Run Utility.

- In the Year-to-Year Transfer dialog, click the folder where you installed the prior year Simple Tax 1040 program and then click OK. For example, click Xlink19 to Proforma Simple Tax 1040 2019 tax return files.

![]()