SSN already accepted

If you get a refusal from Central Site (CS) stating the SSN has previously been accepted, you can check to make sure if sent the accepted return with that SSN.

- Click on the Refusal to open the return.

- Return will open to the Information and Status page.

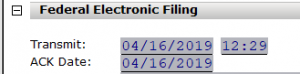

- Under the FEDERAL ELECTRONIC FILING bar you will see Transmit, ACK Date. If there is date in the Transmit that would be the date you transmitted the return to the IRS. If you see a date on ACK Date that is the date the return was Acknowledged by the IRS.

- If you have an ACK Date that means the return you transmitted to the IRS has already been Acknowledged and the reason you have a Refusal is because most likely it was transmitted twice to IRS.

NOTE: At this point you DO NOT have to do anything else as your return is already Acknowledged.

SSN file by another User ID

If you get a refusal from Central Site (CS) stating the social security number (SSN) was filed by another User ID, please contact Simple TAX Support at (281) 833-9300 option 2 for further assistance.

How to find the reason that the IRS or state rejected a tax return

How to find the reason that the IRS or state rejected a tax return

SUMMARY

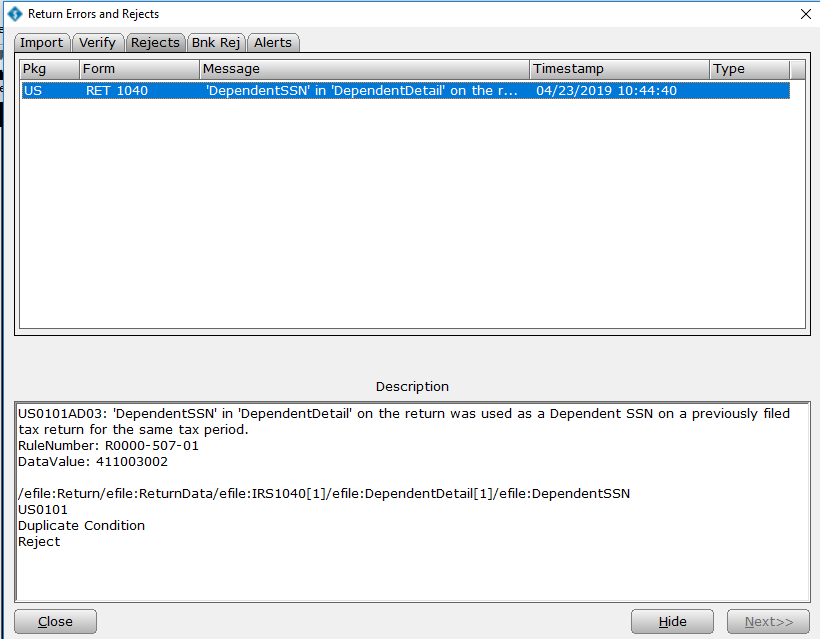

This article demonstrates how to look up the reason the IRS or state rejected a tax return.

MORE INFORMATION

To find the reason the IRS or state rejected a tax return, follow these steps:

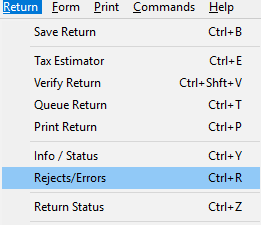

- From within the tax return experiencing the issue, click Return at the top of Menu and then click Rejects/Errors.

- NOTE: The rejection appears on your screen. If no rejects appear, try pressing Ctrl + R.

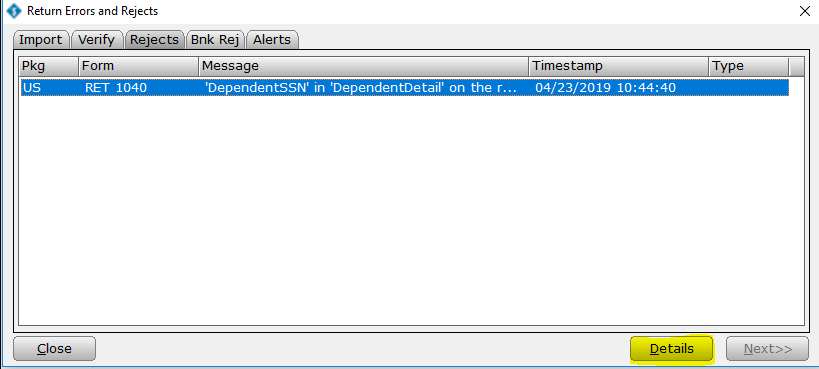

- Once the list of rejections appears on your screen, click the desired rejection to highlight it blue, and then press the Details button to display more information about that specific rejection

- If you want Simple Tax 1040 to take you to the form and field containing the error, simply double-click the reject error.