How to change the primary taxpayer Social Security number in a tax return

How to change the primary taxpayer Social Security number in a tax return

SUMMARY

This article demonstrates how to change the primary taxpayer Social Security number (SSN) in a tax return.

MORE INFORMATION

After electronically filing a tax return to the IRS, the IRS may reject a tax return for code 315 – The primary taxpayer’s SSN and primary taxpayer’s last name must match data from the IRS Database. This rejection means that either the taxpayer’s name or Social Security Number does not match the information that the IRS has on file. If you determine that you have incorrectly entered the primary taxpayer’s Social Security Number, you can easily change it in Simple Tax 1040.

To change a primary taxpayer’s Social Security Number, follow these steps:

- Open the return with the Social Security number you want to change.

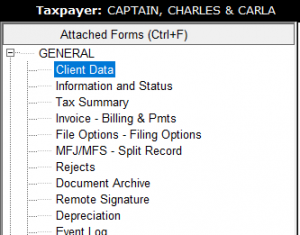

- On the attached forms navigation pane, double-click Client Data.

- In the SSN box under Taxpayer Information, type the new Social Security number.

![]()

- Click Refresh and Simple Tax 1040 changes the Social Security Number on all underlying forms and worksheets.

Important: If the taxpayer is applying for Bank Product, it will be necessary to delete the current Form 8879 and add a new one. Continue to step 5 if the taxpayer is applying for a Bank Product. If the taxpayer is NOT applying for a Bank Product, ignore the steps below.

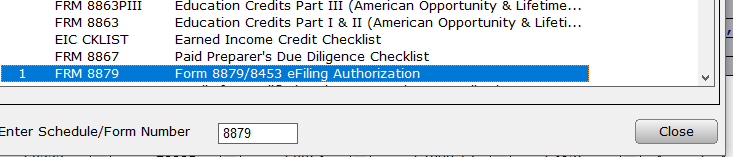

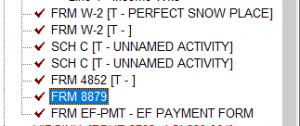

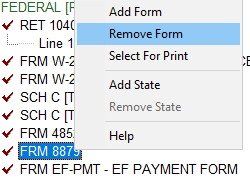

- In the attached forms navigation page, double-click Form 8879 and then click Remove Form.

- Click OK to confirm the deletion.

- Click Add Form and add Form 8879 from the list of available forms. Enter any applicable information that needs to be included in the form.