How to find the reason that the IRS or state rejected a tax return

How to find the reason that the IRS or state rejected a tax return

SUMMARY

This article demonstrates how to look up the reason the IRS or state rejected a tax return.

MORE INFORMATION

To find the reason the IRS or state rejected a tax return, follow these steps:

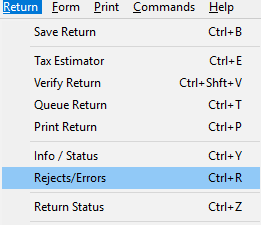

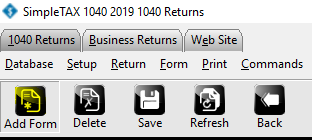

- From within the tax return experiencing the issue, click Return at the top of Menu and then click Rejects/Errors.

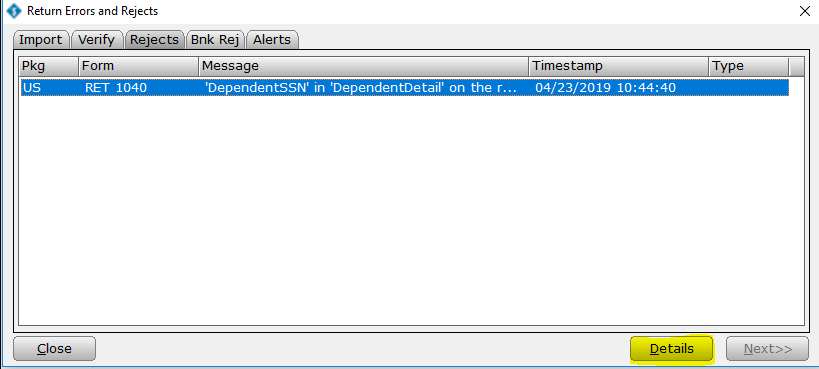

- NOTE: The rejection appears on your screen. If no rejects appear, try pressing Ctrl + R.

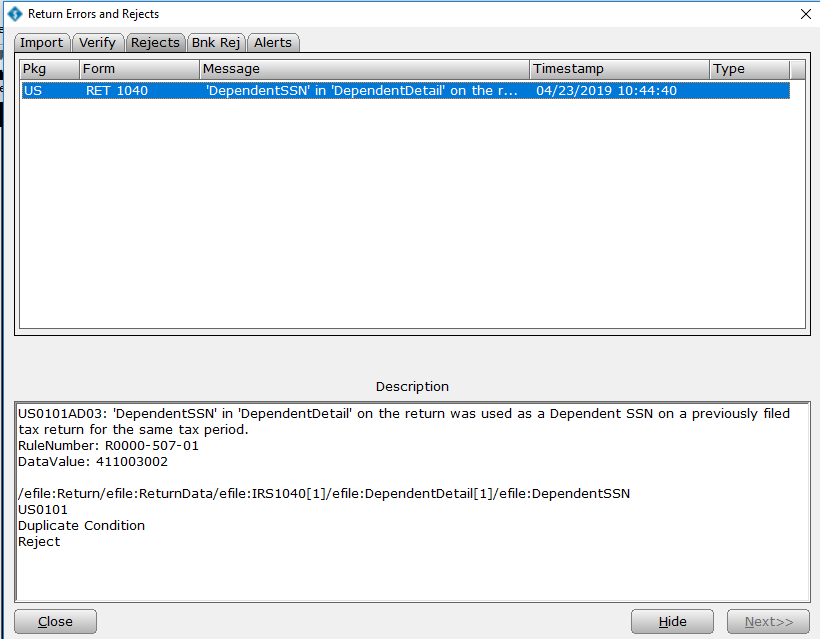

- Once the list of rejections appears on your screen, click the desired rejection to highlight it blue, and then press the Details button to display more information about that specific rejection

- If you want Simple Tax 1040 to take you to the form and field containing the error, simply double-click the reject error.

How to remove a state from a return

SUMMARY

This article demonstrates how to remove a state from a tax return.

MORE INFORMATION

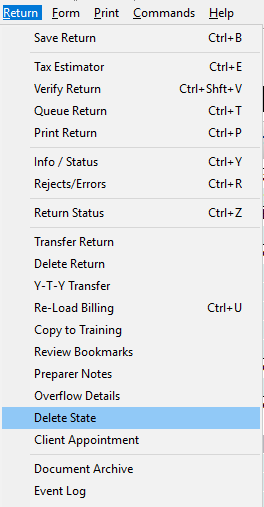

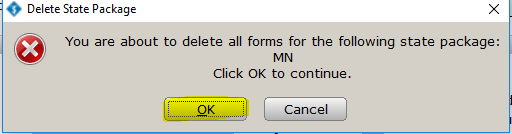

Method 1: Click Delete State from the Return menu.

- Open the tax return.

- On the Return menu, click Delete State.

- Click the state you want to delete and then click OK.

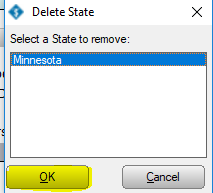

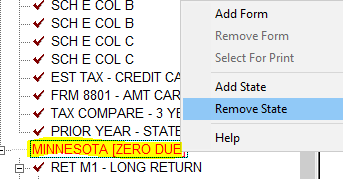

Method 2: Right-click the state return and select Remove State

- Open the tax return.

- In the Attached Forms section, right-click the state you want to delete, and then click Remove State.

- Click OK on the Delete State Package dialog.

How to electronically file the state tax return before you electronically file the federal tax return or if you’ve already filed the federal return by mail and want to electronically file the state return

How to electronically file the state tax return before you electronically file the federal tax return or if you’ve already filed the federal return by mail and want to electronically file the state return

SUMMARY

This article demonstrates how to electronically file the state tax return before you electronically file the federal tax return or if you’ve already filed the federal return by mail and want to electronically file the state return.

MORE INFORMATION

New for 2010, you can transmit the state return before the federal return. To send the state return first, follow these steps:

- Add the state electronic filing form to the return.

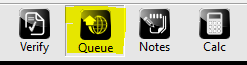

- Click Queue on the toolbar.

- Select the check box for the state you want to transmit. Do not select the Federal check box.

- Click Queue. Simple Tax 1040 takes you to the Work in Progress screen.

![]()

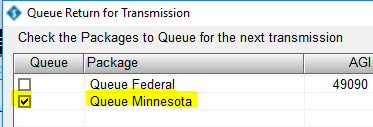

- Click Transmit on the toolbar.

- Click Transmit on the Transmit to Central Site dialog.

How to add a state return to an existing federal return

How to add a state return to an existing federal return

SUMMARY

This article demonstrates how to add a state tax return to an existing federal tax return.

MORE INFORMATION

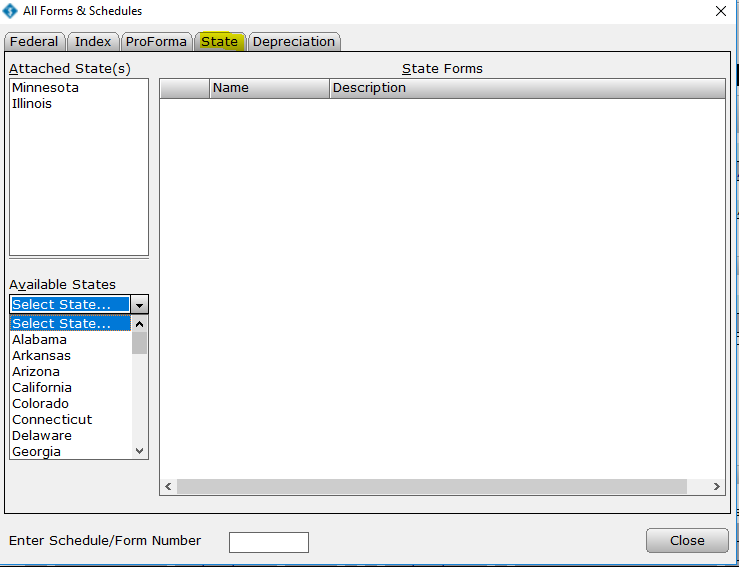

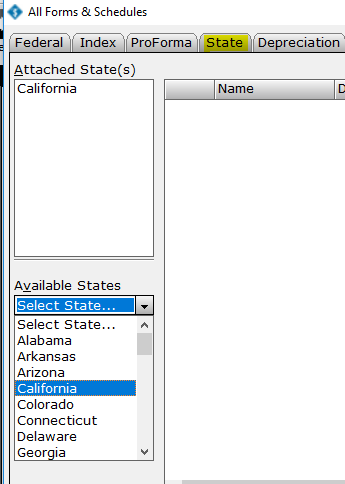

To add a state return, follow these steps:

- If you haven’t done so already, install the state you want to add to the return.

- Open the appropriate tax return.

- Click the Add Form button, or press Ctrl+S on your keyboard.

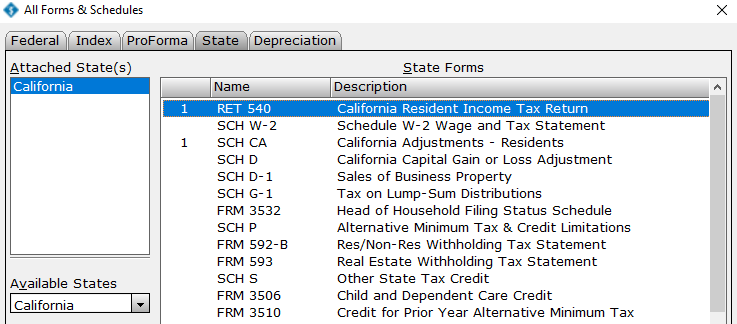

- On the States tab, click the state you want to add in the Available States list. (Example: California)

- Double-click the state main form you want to add to the tax return. (Example: California)