When to use Form 4852, Substitute for Form W-2 or 1099-R, and how to complete the form in Simple Tax 1040

When to use Form 4852, Substitute for Form W-2 or 1099-R, and how to complete the form in Simple Tax 1040

SUMMARY

This article provides demonstrates when to use Form 4852, Substitute for Form W-2 or 1099-R, and how to complete the form in Simple Tax 1040.

MORE INFORMATION

Before using Form 4852

Form 4852 is only to be used as a substitute after you’ve exhausted all other means of obtaining Form W-2 or 1099-R. Form 4852 is generally not filed before April 15; however you should call the IRS at (800) 829-1040 if you have not received Form W-2 or Form 1099-R by February 15.

To complete Form 4852 in Simple Tax 1040, follow these steps:

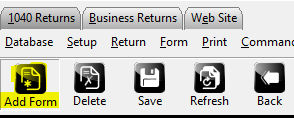

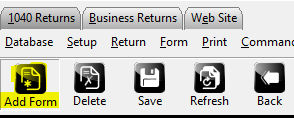

- Click Add Form on the tax return toolbar.

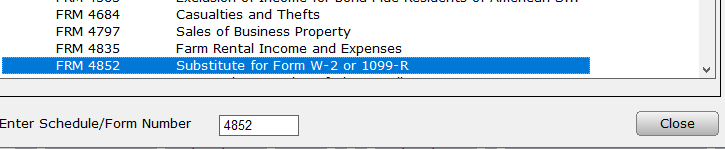

- In the Enter Schedule/Form Number box, type 4852. When you see FRM 4852 in the list, double-click it and Simple Tax 1040 adds the form to the return.

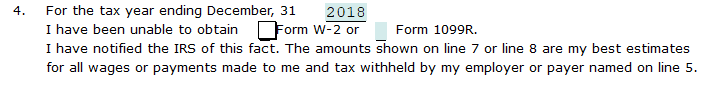

- On Line 4, select either the Form W-2 or Form 1099R check box, depending on which form the Form 4852 is being filed as a substitute for.

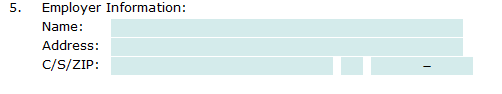

- In Line 5, type the employer or payer information.

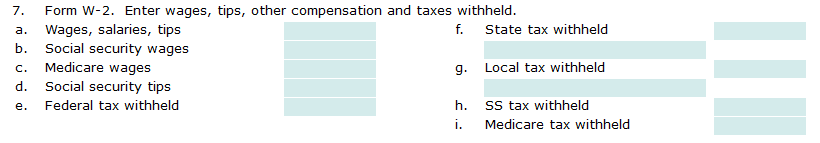

- If completing for Form W-2, enter the information on Line 7 of Form 4852. If completing for Form 1099-R, enter the information onLine 8 of Form 4852.

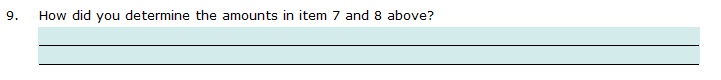

- On Line 9, type the method used to determine the amounts entered on Line 7 or 8 of Form 4852.

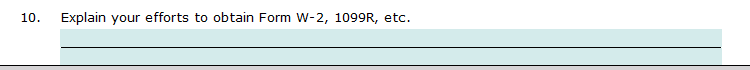

- On Line 10, type an explanation of what efforts were taken to obtain Form W-2 or 1099R.

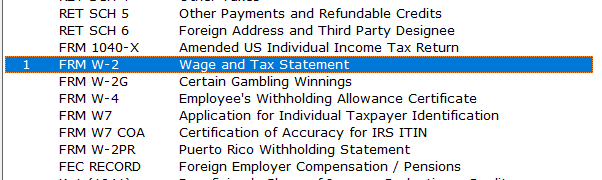

- Click Add Form on the tax return toolbar.

- Depending on which form was not received, either double-click FRM W-2 or double-click FRM 1099-R.

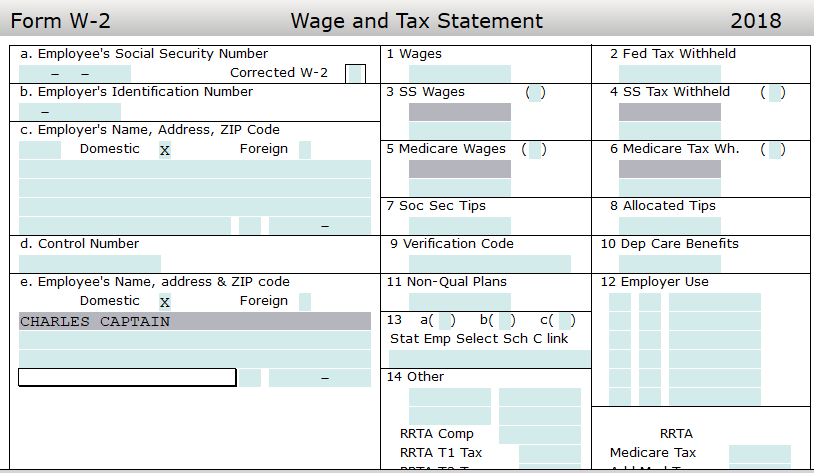

- Complete Form W-2 or Form 1099-R using the information from Form 4852.

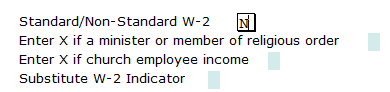

- If you completed Form W-2, type N in the Standard/Non-Standard W-2 box. If you completed Form 1099-R, type N in the Standard/Non box.

Important

- Be sure to keep a signed copy of Form 4852 for your records.

- If you file the affected tax return by mail, include Form 4852 instead of the non-standard W-2 or 1099-R.

- Although the EIN is not required for Form 4852, it is required in order to e-file the tax return. If the EIN cannot be obtained the return must be paper filed.