How to back up a single return in Simple Tax 1040

How to back up a single return in Simple Tax 1040

SUMMARY

This article demonstrates how to back up a single tax return and restore it on another computer.

MORE INFORMATION

Use Transfer Return to copy a tax return to a new computer. When you transfer a tax return, you back up a copy of the tax return and restore it on another computer. To transfer the return, you’ll need to have access to portable media. There are many types of portable media: you can use CD-R, DVD-R, Zip drives, Jazz drives, tape drives and more. Be sure to choose the right one based on how much information you want to save.

Step 1: Back up the return.

To back up a tax return, follow these steps:

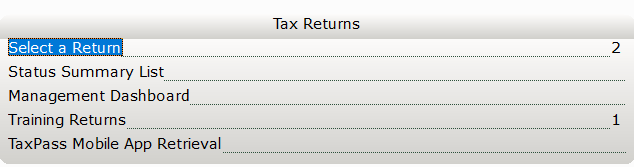

- From the Work In Progress screen, click Select a Return.

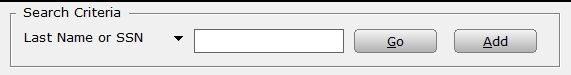

- In the Last Name or SSN box, type the Social Security Number of the tax return you want to transfer and then click Go.

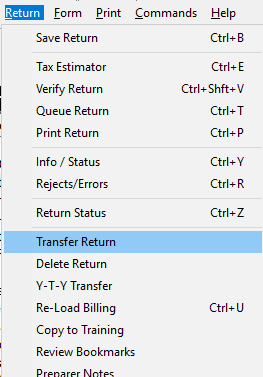

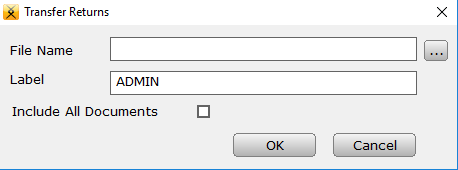

- On the Return menu, click Transfer Return. The Transfer Returns dialog appears.

- In the File Name box, type the folder where you want to save the save the tax return file.

- In the Label box, type a description for the tax return.

- Click OK and Simple Tax 1040 copies the tax return to the location you selected.

Step 2: Restore the return

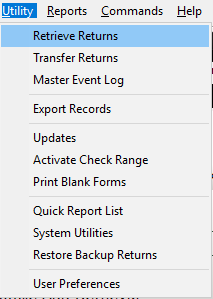

- On the Utility menu in Simple Tax 1040, click Retrieve Returns.

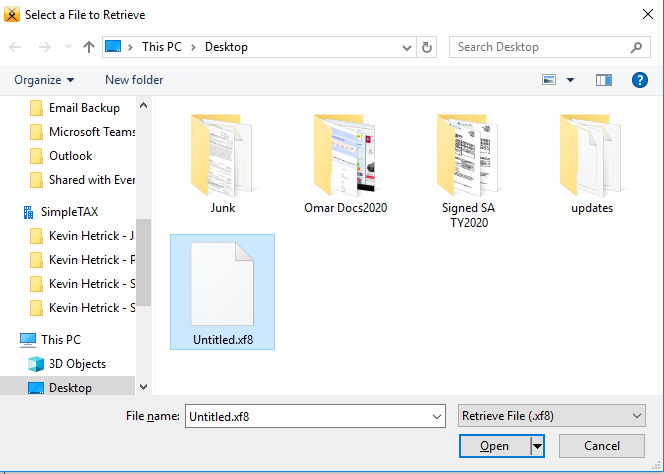

- In the Select a File to Retrieve dialog, browse to the folder where you saved the backed up tax return.

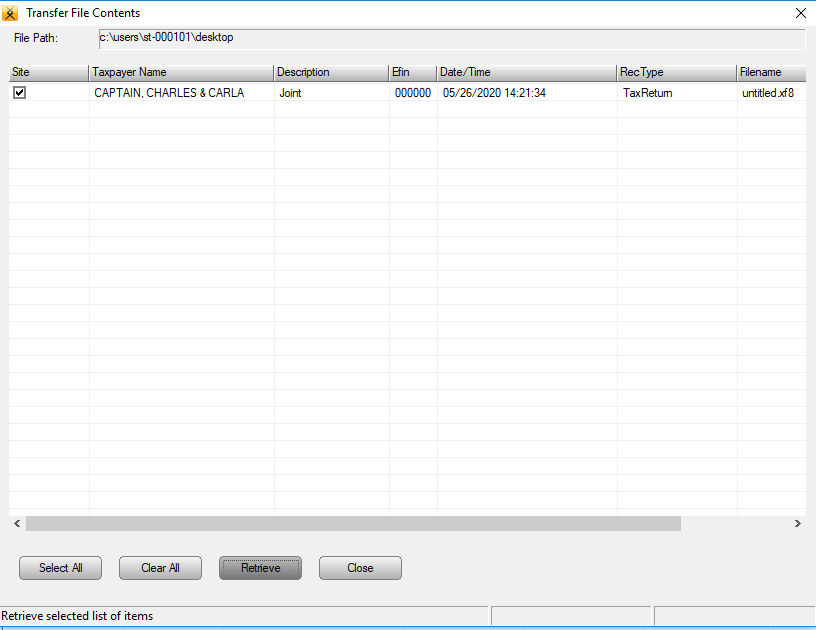

- In the Transfer File Contents dialog, select the check box in the Site column for the return you want to open and then click Retrieve. The return now appears in the Lookup screen. Double-click the return you want to open.