How Can We Help?

How to add an asset to a tax return

How to add an asset to a tax return

SUMMARY

This article demonstrates how to add an asset to a tax return.

MORE INFORMATION

To add an asset to a tax return, follow these steps:

- Add or verify that the form to carry depreciation to exists on the tax return. For example, if you want the depreciation to appear on Schedule C, be sure you’ve added Schedule C to the tax return.

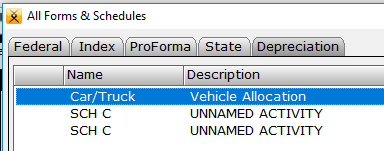

- Press CTRL+N to open the All Forms & Schedules, Depreciation screen.

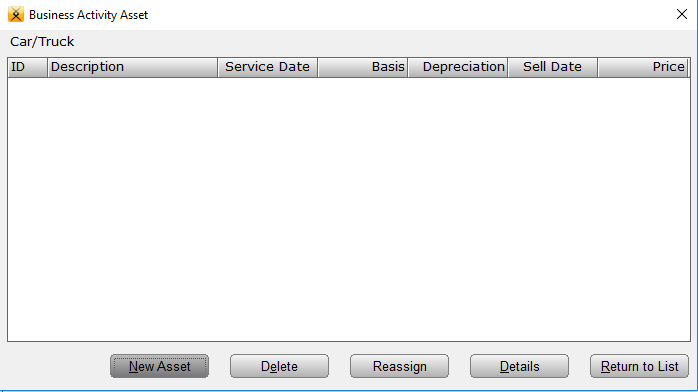

- Double-click the business activity to open the Business Activity Asset window and click New Asset.

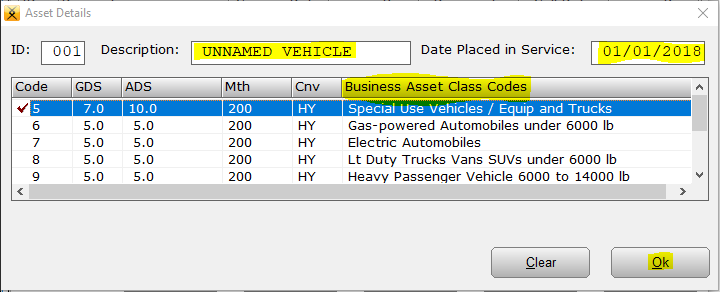

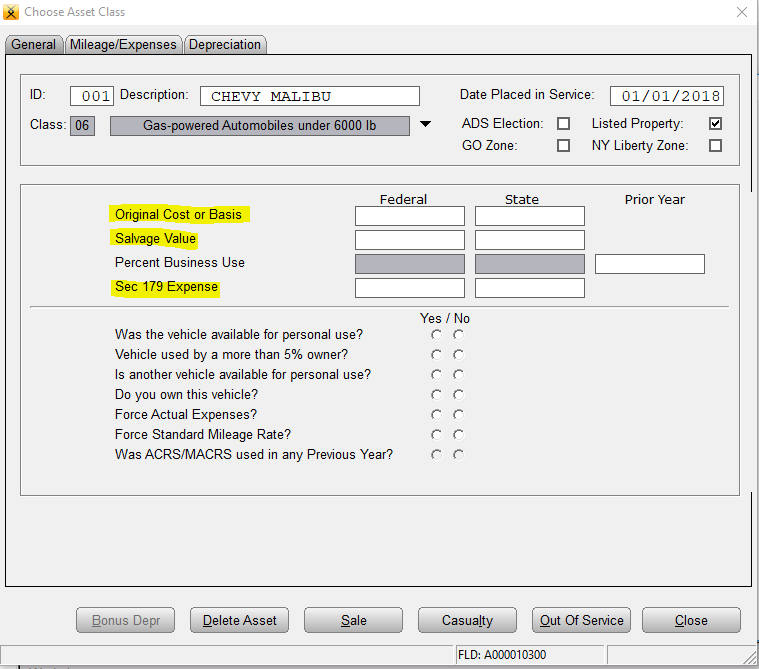

- In the Description box, type a name for the asset. In the Date Placed in Service box, type the date the asset was placed in service. Select the appropriate Business Asset Class and click OK.

- On the General tab, type the original cost or basis of the asset in the Original Cost or Basis box.

- If the original cost or basis includes land, type the value of land in the Salvage Value box.

- If claiming the Section 179 deduction, type the amount elected for the Section 179 deduction in the Sec 179 Expense box.

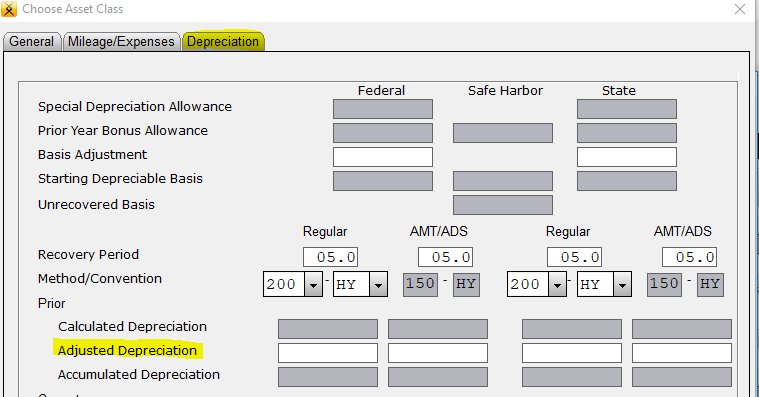

- If the asset has prior year depreciation amounts, click the Depreciation tab and type the prior year depreciation in the Adjusted Depreciation box.