How Can We Help?

How to create and electronically file Form 4868 in Keep It Simple Desktop and Online

Preparation and Filing of Form 4868:

- Create new return as 1040 (If a tax return is already created, edit the existing tax return)

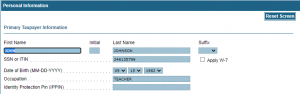

- Complete the Personal Information page for the taxpayer.

- Click SAVE.

![]()

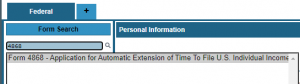

- Add Form 4868.

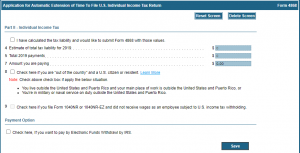

- Complete the form and click SAVE.

You have a few options with the 4868.

- If income and with-holdings have been entered into the tax return, software will fill in lines 4 and 5. By checking the box “I have calculated the tax liability and would like to submit Form 4868 with those values.” We will allow manual entry to the lines.

![]()

- This page can be filed with all 0’s. By saving the blank 4868 entry page, we will transmit with no values, only personal information.

![]()

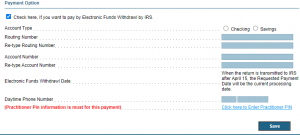

- If you are paying with the extension electronically, complete the Electronic Funds Withdrawal information on the screen before saving.

- NOTE: When using EFW with a filed extension, this is the only time Form 8879 must be completed.

- After completing the 4868 and 8879 (if needed), choose to CLOSE the return entries. You will NOT mark the return as Complete and you will NOT complete Client Payment.

- We will display the following message: “You have prepared Form 4868 for this client. In order to file extension, you need to transmit this information to SIMPLETAX.CO”

- Click OK

Click “Transmit NOW” next to EXTENSION on the PAYMENT AND EFILE DETAILS.

Click “Transmit NOW” next to EXTENSION on the PAYMENT AND EFILE DETAILS.

![]()

Receiving Extension Acknowledgements:

To check the status of extensions, go to the E-file Tab, and click on Extension.