How Can We Help?

New Estimator

This article will show you how to do a tax estimate.

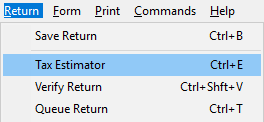

- After you add a new return, click Return and select Tax Estimator.

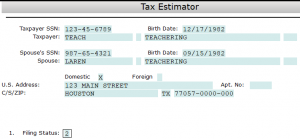

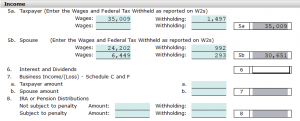

- In the Tax Estimator, fill out as much information as possible to get the best estimate.

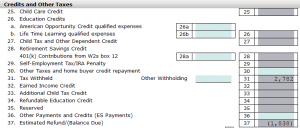

- Under Credit and Other Items you will see Estimated Refund/ (Balance Due) that will show you what the estimated refund or balance due will be based on the information you provided.