An updated amount in the billing schedule does not appear on the invoice in a tax return

SYMPTOMS

When you update the amount you want to charge for the 1040, 1040A, or 1040EZ, the new billing amount does not appear on the Billing and Invoice screen.

CAUSE

This issue occurs because Simple Tax 1040 requires you to delete the form to update the fee.

RESOLUTION

Reload the billing scheme (2010 and above)

- Open the applicable tax return.

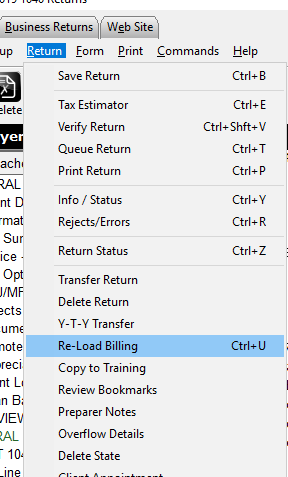

- On the Return menu, click Re-Load Billing.

How to set up Simple Tax 1040 to charge the same tax preparation amount for every return you prepare

How to set up SimpleTAX 1040 to charge the same tax preparation amount for every return you prepare

SUMMARY

This article demonstrates how to set up SimpleTAX 1040 to charge the same tax preparation amount for every return that you prepare (flat rate billing).

MORE INFORMATION

25 STEPS

1. Click Billing

2. Click the check box for No Prior Year Balance or Invoice

3. Click the check box for No Prior Year Preparation Fee on Invoice

4. Click Form Billing

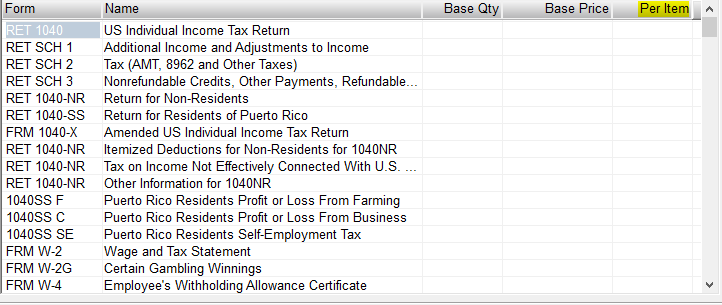

5. Enter your prices under Per Item column

6. Select a State to add your Preparation Fees to the State Forms from the drop down menu.

7. Click Worksheet

8. Enter your prices under Per Item

9. Select a State to add you Preparation Fees to the State Forms fro,m the drop down menu.

10. Click Line Items

11. Enter your prices under Per Item

12. Select a State to add Preparation Fees to the State Forms from the drop down menu.

13. Click Discounts

14. Enter a Discount Name

15. Enter a Discount Percentage or Discount Amount

16. Click Custom Charges

17. Enter Charge Description

18. Enter Amount

19. Click Custom Settings

20. Audit Assistance, Protection Plus is automatically being added to each return, If you wish to NOT have it add automatically un-check the boxes.

21. If you wish to keep Audit Assistance, Protection Plus automatically being added and want to add your fee for the product, you can enter your fee up to $55 in the Add On Fee/Mark Up Amount.

That additional fee is paid to you as the preparer.

22. Click OK

23. Enter the name of the new Billing Scheme.for this Tax Season.

24. Click OK

25. You will get a message stating "There is no default billing Schena Selected. Do you wish to set current schema as default?" Click Yes and you are Done!

Here's an interactive tutorial

https://www.iorad.com/player/1691149/Software-Setup-Wizard-for-Billing

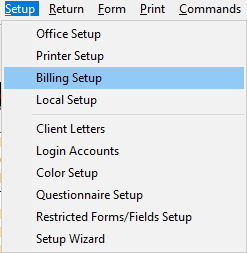

- On the Setup menu, click Billing Setup.

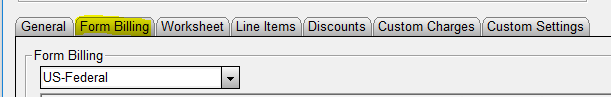

- Click the Form Billing tab.

- Type your tax preparation fee in the 1040 row in the Per Item column.

- Click OK.

Note: On any returns created prior to this setup, open the return and click on "RETURN" at the top Menu and then click "Re-load Billing" from the drop down menu to set the billing for that return.