Retrieving a Return from MyTaxOffice Mobile App in KIS Online

Retrieving a Return from MyTaxOffice Mobile App

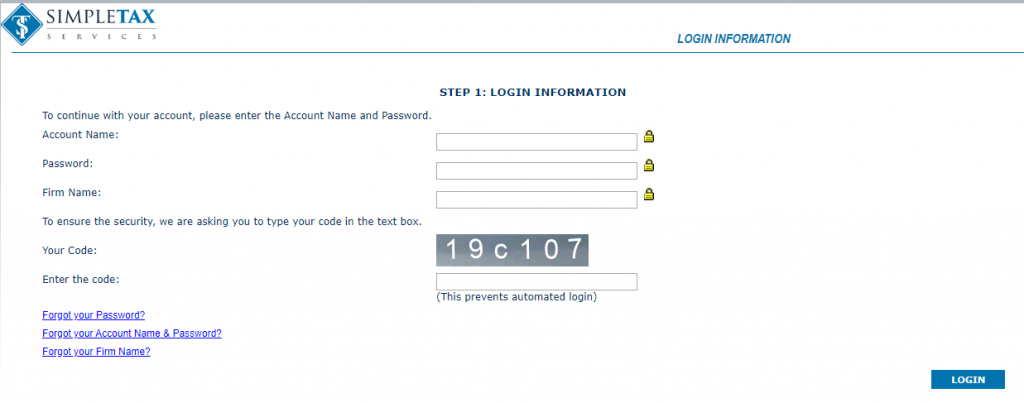

- Once your customer has created a new return through the MyTaxOffice Mobile App, you can log in to your KIS Online

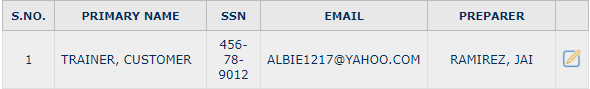

- You will get a pop-up message saying “New Returns are created from MyTaxOffice App.” Clock View Return(s) to see the returns.

- Click on the Primary Name to open the return.

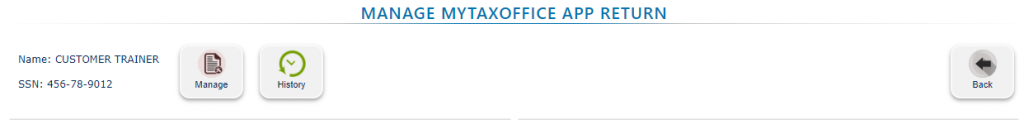

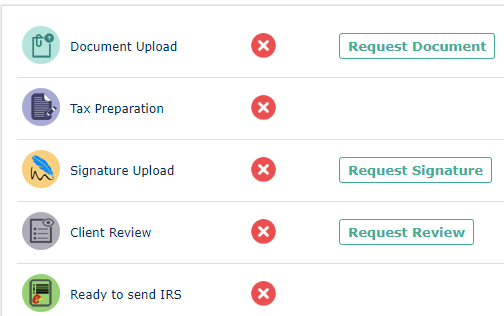

- You will be directed to the Manage MyTaxOffice App Return

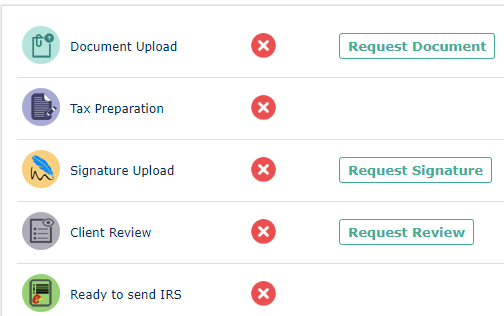

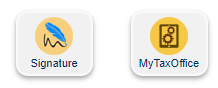

- From the Manage MyTaxOffice App Return screen you can View and Send Messages to the taxpayer, Request Documents, Request Signatures, and Request Review for the taxpayer to review the return.

- To manage the return, you will click on the Manage icon at the left right corner.

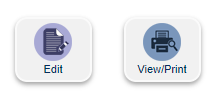

- It will direct you to the Client Manager for that return where you can click the Edit icon to edit the return.

- Make any necessary edits on the return and click the Save button at the bottom and then click Complete to mark the return Complete and return the Client Manager.

![]()

- To go to the Manage MyTaxOffice App Return screen, click at the icon on the top right labeled My TaxOffice.

- If your return is completed, you can now send the Request Review and Request Signature, so that the taxpayer can review the return and sign it through their MyTaxOffice Mobile App.

- Once your clients review and sign the return you will be able to Transmit the return to the IRS.

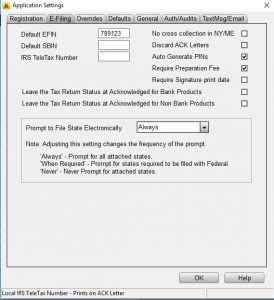

How to complete the Electronic Filing tab of the office setup screen

26 STEPS

1. Once you login to the software, the Software Setup Wizard will appear. Click Office

2. Click E-Filing

3. Enter yore EFIN in the Default EFIN

4. Click Overrides

5. Enter your Company Name

6. Type in your Company Address

7. Type in the City

8. Type in the State

9. Type in rthe Zip Code

10. Type in Company Phone Number

11. Enter the ERO's Name

12. Enter the Firm Address

13. Enter the City

14. Enter the State

15. Enter the Zip Code

16. Click Defaults

17. Click check box Auto-save return when closed. This will automatically save the return whenever you close the return or software.

18. Click General

19. If you had the same software the previous year, enter the Prior Year Path or click Browse to select if from your PC.

20. Click OK

21. Click Auth/Audits

22. Here you can use each button to configure Diagnostic validation checks if you like to know how check out our Software Setup Wizard for Audit Control video. Click OK to continue.

23. Click TextMsg/Email

24. Enter your Gmail Email Address

25. Enter the Password to the Gmail Email Address above.

26. Click OK

Here's an interactive tutorial

https://www.iorad.com/player/1691107/Software-Setup-Wizard-for-Office-Setup

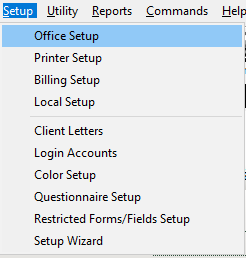

To complete the Electronic Filing tab, follow these steps:

- On the Setup menu, click Office Setup.

- On the Electronic Filing tab, complete the information as follows:

Field

Description

Default EFIN

Type your default electronic filing identification number (EFIN). An EFIN is assigned to you by the IRS when you complete and file Form 8633, Application to Participate in the e-file Program.

Auto Generate PINs

Select this check box to automatically generate PINs for Form 8879.

Require Preparation Fee

Select this check box if you want to prevent returns with a bank product from being transmitted with $0 Preparation Fee.

Prompt to file state electronically

Select one of the following options:

- Always: The user will be prompted by a Verify Error when the return is transmitted if a State Electronic Filing Signature Document (Form 8453) is missing. This will always occur regardless of whether the state return must be electronically filed.

- When Required: The user will be prompted by a Verify Error when the return is transmitted and the state return is required to be filed with the federal return, if a State Electronic Filing Signature Document (Form 8453) is missing.

- Never: The user will not be prompted under either circumstance.

- When finished, click OK.