Electronic Signature Setup in KIS Desktop

This article will show you how to Setup the Firm Signature and Preparer Signature in your software.

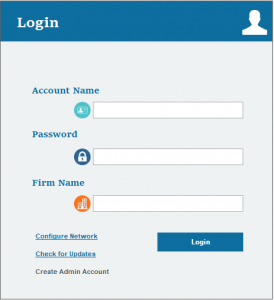

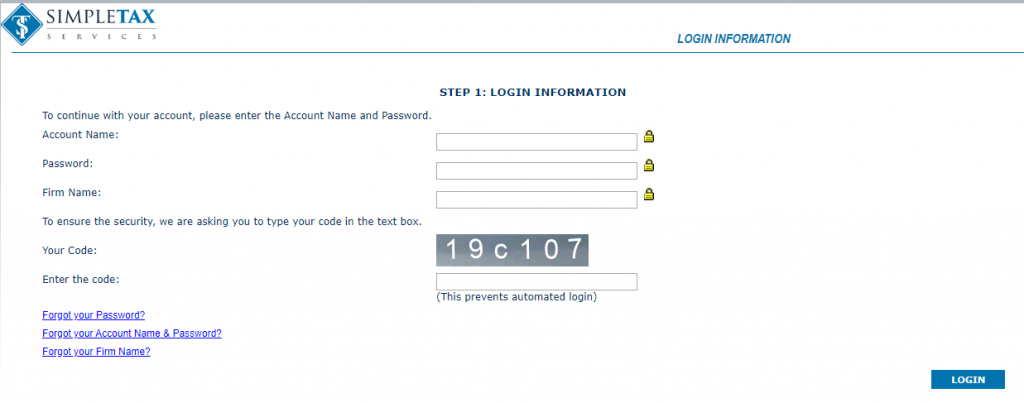

- Login to your KIS DESKTOP

- Click on the SETUP tab at the top right corner.

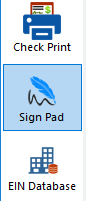

- Click on the Sig Pad icon on the left side (6th one down).

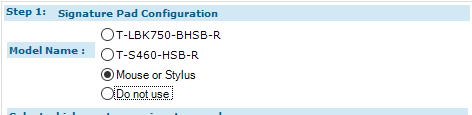

- On Step 1: Signature Pad Configuration select the Model Name of your signature pad if you have one or select Mouse or Stylus to use your computer’s mouse or a stylus.

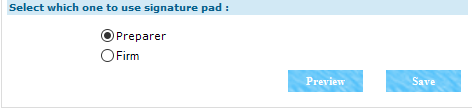

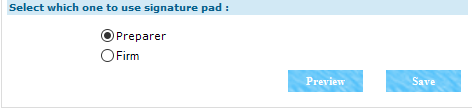

- On Select which one to use signature pad, select which signature you want to do first, Firm or Preparer.

- Click START next to the selected signature box.

- Sign inside the box using your mouse or signature pad and click SAVE.

- To sign the other signature box, go back Select which one to use signature pad, select which signature you want to do first, Firm or Preparer.

- Click START next to the selected signature.

- Sign inside the box using your mouse or signature pad and click SAVE.

Electronic Signature Setup on KIS Online

This article will show you how to Setup the Firm Signature and Preparer Signature in your software.

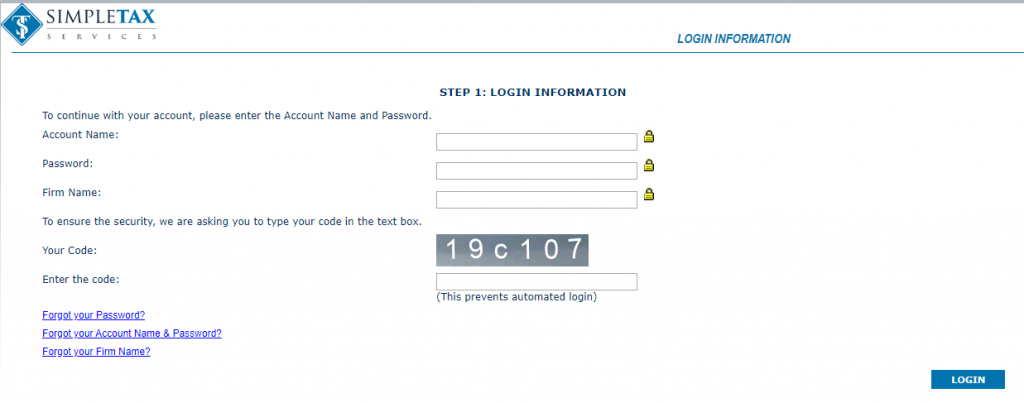

- Login to your KIS ONLINE software.

- Click on the SETUP tab at the top right corner.

- Click on the Sig Pad icon on the left side (5th one down).

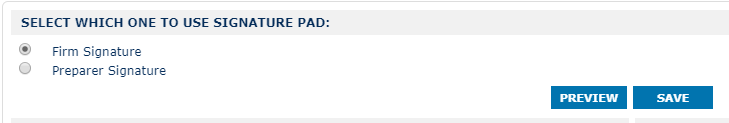

- On SELECT WHICH ONE TO USE SIGNATURE PAD and select which signature you want to do first, Firm Signature or Preparer Signature.

- Click START under the selected signature box.

![]()

- Sign inside the box using your mouse or signature pad and click SAVE SIGNATURE.

- To sign the other signature box, go back to SELECT WHICH ONE TO USE SIGNATURE PAD and select which signature you want to do, Firm Signature or Preparer Signature.

- Click START under the selected signature.

![]()

- Sign inside the box using your mouse or signature pad and click SAVE SIGNATURE.

NOTE: If you have multiple preparers, you will need to have each preparer sign. You can select the preparer from the Select Preparer drop box under PREPARER SIGNATURE.

How to create a preparer account

How to create a preparer account

The objective of this article is to walk you through on how to create a preparer account.

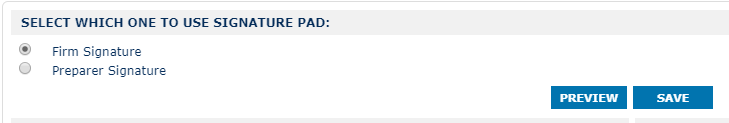

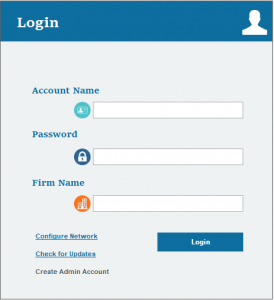

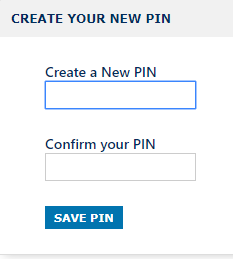

- Login to your KIS Online or KIS Desktopsoftware.

- Click on the SETUP tab at the top right corner.

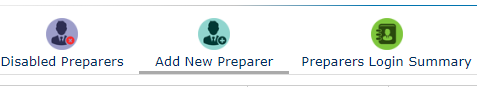

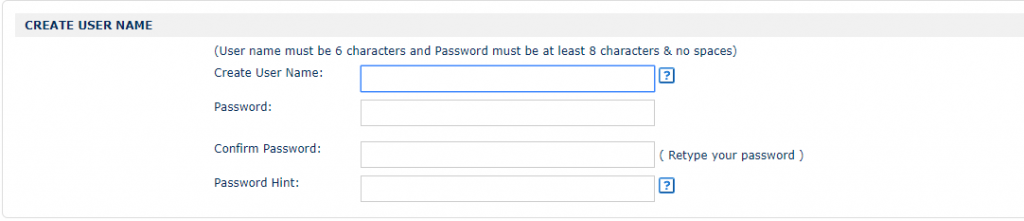

- You will automatically be take top the PREPARER INFORMATION screen. Click on the third icon at the top that says Add New Preparer.

- Enter the information to create the User Name for your preparer and their password. This is what they will use to log in to the software.

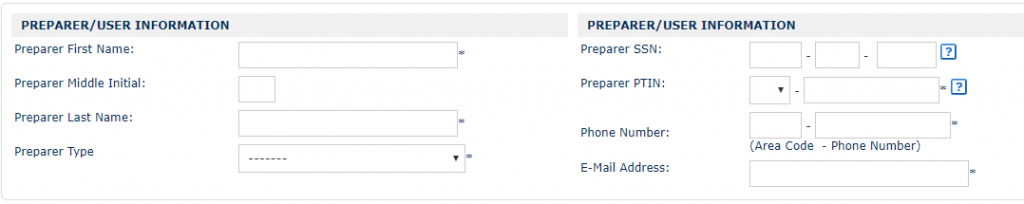

- Please enter the Preparer information and make sure you include their name, email and PTIN.

- Scroll to the bottom of the page and under USER OPTIONS select what you will allow the preparer to do and select the privileges.

- Once done, click on the blue button that says CREATE NEW USER, to save the information.

![]()

RECOMMENDED

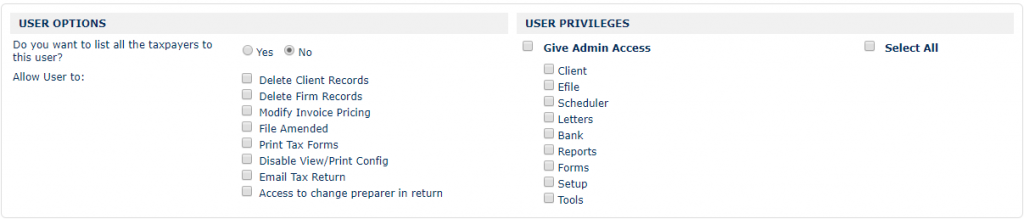

Once you click on CREATE NEW USER, you will be directed to the SECURITY QUESTION tab.

Now you will be directed to the LOGIN SECURITY tab.

- Select a question from the drop box for Security Question 1 and enter the answer below it. Do the same for Question 2 and 3.

- Once you answer all three Security Questions, click on the blue button on the lower right of the screen that says SAVE CHANGES.

![]()

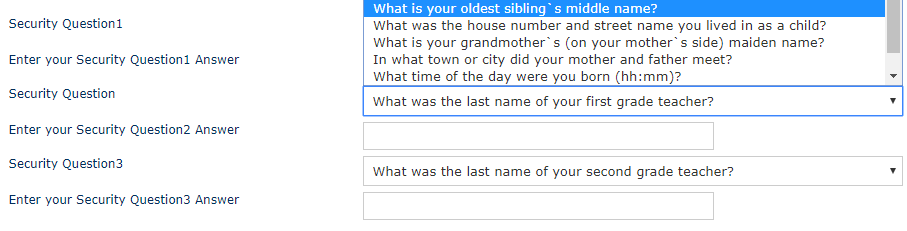

Now you will be directed to the SECURE PASS tab. This is to ensure extra protection to all your clients personal information.

- Under TWO STEP AUTHENTICATION click on the green button that says Activate Login Code Security.

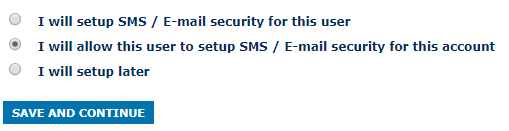

- Check the box in front of the phrase “ I will allow this user to setup SMS / E-mail security for this account." Click on the blue button at the lower right corner that says SAVE AND CONTINUE to save this change.

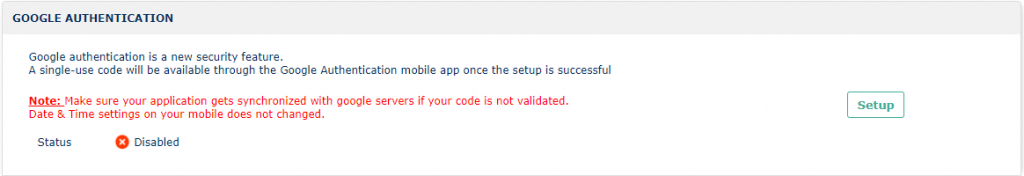

- Under GOOGLE AUTHENTICATION click on the green Setup button to set up.

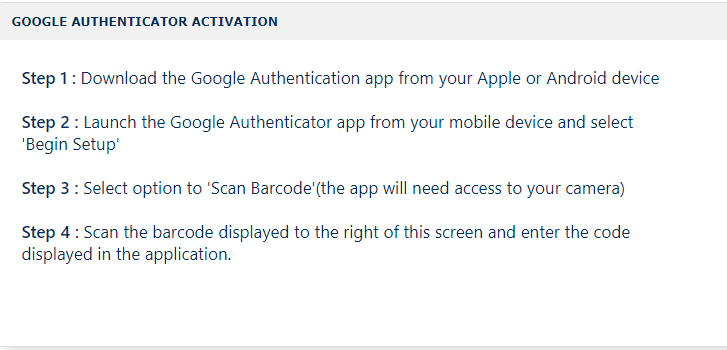

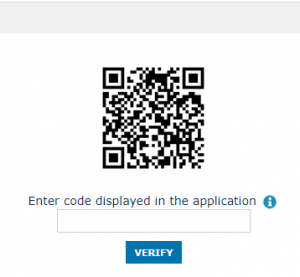

- Follow the instructions and download the Google Authentication app to your Apple or Android phone and proceed with the next steps.

- Once you receive your code to your mobile phone, enter the code under the Barcode and click on the blue button that says VERIFY.

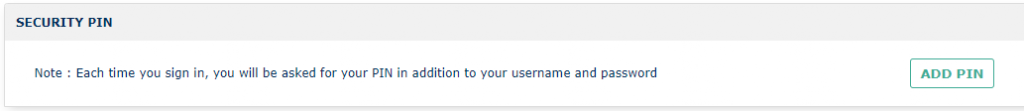

- Under SECURITY PIN click on the green button that says ADD PIN.

- Enter a 4 digit numerical pin on the Create a NEW PIN box and then confirm it on the Confirm Your PIN box.

- Click on the blue box below that says SAVE PIN.

Now you have successfully created a preparer account.

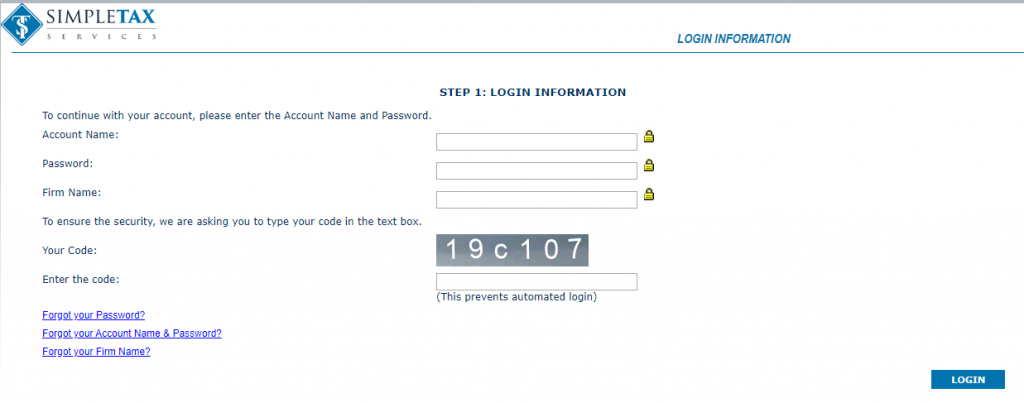

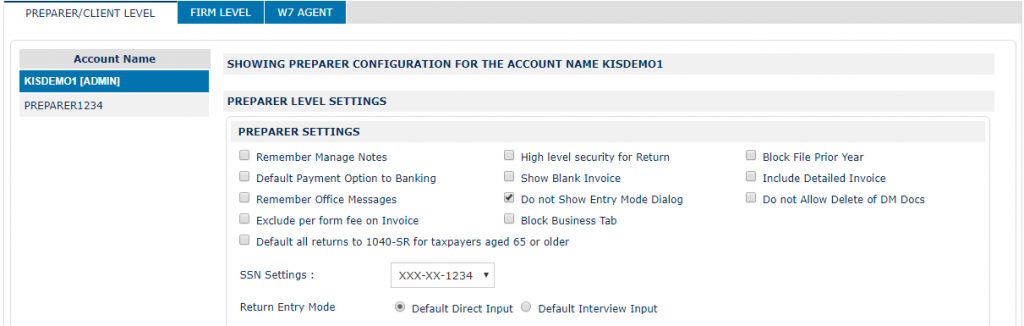

Setting Preparer Settings

The objective of this article is to walk you through on how to set preparer settings.

- Login to your KIS ONLINE software.

- Click on the SETUP tab at the top right corner.

- Click on the third icon on the left-hand side labeled SETTINGS.

- It will automatically open to the PREPARER/CLIENT LEVEL where you will see there are some setting levels already automatically set for you. You can select additional settings by checking the box next to the desired setting level.

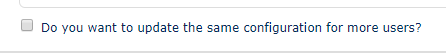

- You can click SAVE CHANGES to save the changes for this one preparer or

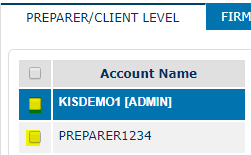

- You can check the box DO YOU WANT TO UPDATE SAME CONFIGURATION FOR MORE USERS? to do the same changes to the other preparers.

- Click on the box next the preparer you wish to make the same changes to,

- Then click SAVE CHANGES.

Setting Preparer Remote Signature

Preparer Remote Signature

8 STEPS

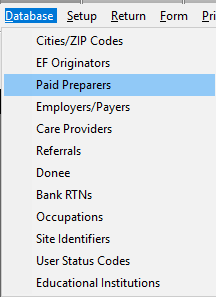

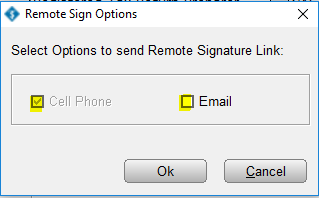

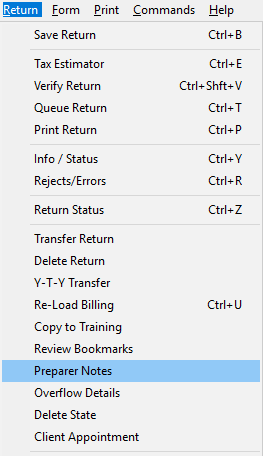

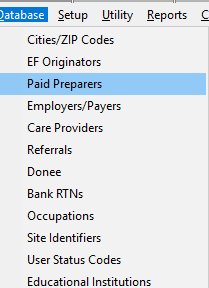

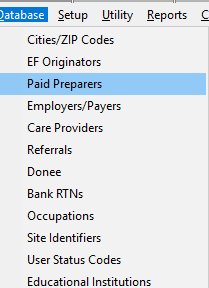

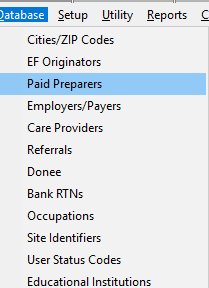

1. From the Work In Progress Screen (WIP) click Database

2. Click Paid Preparers

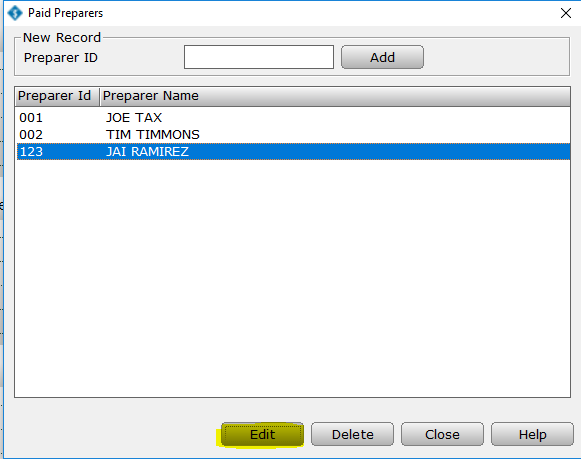

3. Click Edit

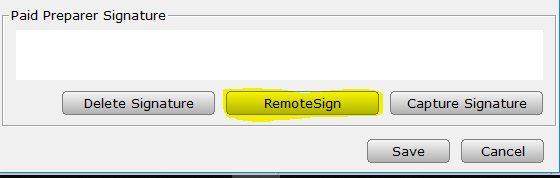

4. Click RemoteSign

5. Cell Phone is already checked for you and grayed out. You also have the option to do it via email. Click OK

6. You will use this information to login to the Signature request. Once you sign and click submit in the request, click OK

7. Click Edit to confirm the signature is on the paid preparer profile.

8. Click Save

Here's an interactive tutorial

https://www.iorad.com/player/1692316/Remote-Signature-Setup-for-Preparers

Requirements:

- Preparer SSN/PTIN, ERO’s Name, Cell Phone and Cell Phone Carrier (email address is optional)

- Desktop Software must have Internet access

- Preparer needs to have a smartphone with Internet access or access to their email address via the internet.

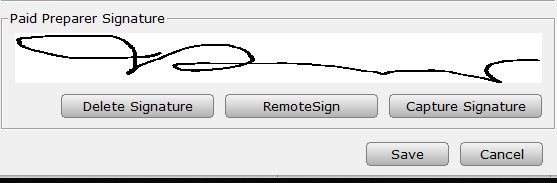

How to capture/update Preparer Signature using RemoteSign:

- Login to Simple TAX 1040 software with Administrator privilege, click Database menu and select Paid Preparers

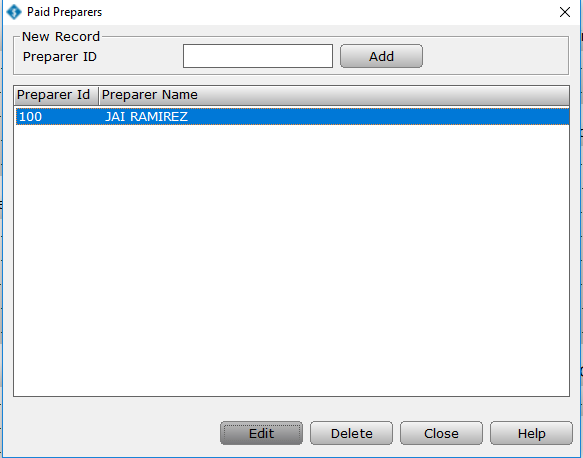

- From the Paid Preparers window select the Preparer and click Edit button (or double click, save you a click)

- From the Paid Preparer Information window, verify the requirement information are entered then click RemoteSign button.

- Select where to send the request to RemoteSign through Cell Phone or Email and click OK. (Note: If you have entered a Cell Phone Number it will automatically be selected)

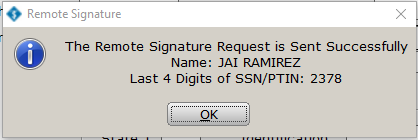

- After clicking OK, Remote Signature Message window will appear, ERO will need this information for authentication. ( Name and Last 4 of SSN/PTIN)

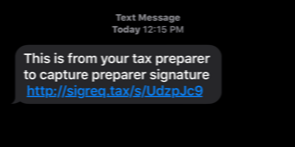

- Software then will send a text message to the Preparer’s cell phone number and email (optional) (standard text messaging rate will apply, please remind users if they have a text messaging plan with their provider).

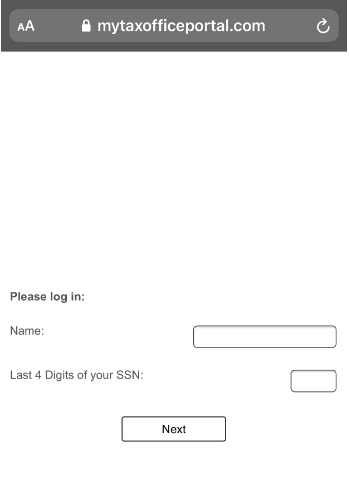

- After clicking the link from the text message, enter the Preparer’s name and last digit of SSN/PTIN exactly as what it indicated on Step 4 (else the user will not be authenticated and will be unable to process the signature request).

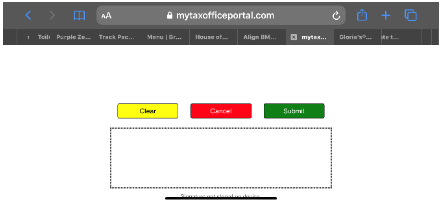

- After entering information click “Next” and once authenticated, the signature page is next. Note: it is important to turn your mobile device sideways to capture the signature properly.

- Once signature is set click Submit button. A verify page will then appear to confirm if preparer is satisfied with the signature, click “No” to go back and recapture signature, click “Yes” to proceed in sending the signature to the desktop software.

- Once submitted, close the Paid Preparer Information window and reopen. Preparer signature should be in place/updated with the new signature

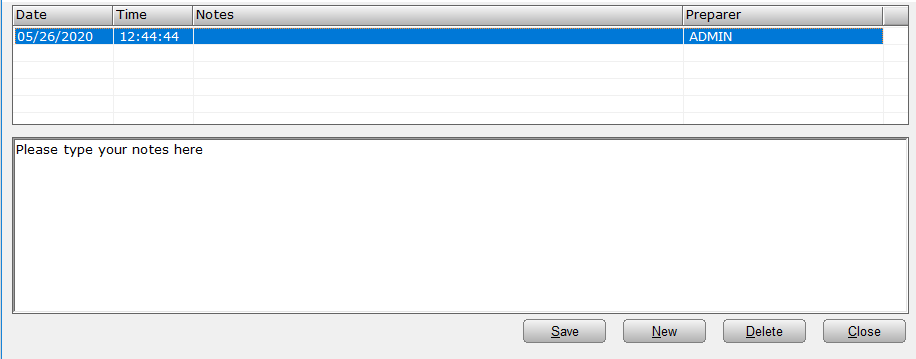

How to add preparer notes to a return

How to add preparer notes to a return

SUMMARY

This article demonstrates how to add preparer notes to a tax return.

MORE INFORMATION

Simple Tax 1040 allows you to attach a note to any data fields as you prepare a return.

Notes are generally used to record and track information important for a specific field, and there are no restrictions as to the type of information you can include. You may want to use a note to record the origin of an entry or to explain why you bookmarked a form or entry.

Notes are for your use only, and they do not transmit to the IRS when you file electronically. You cannot attach a single note to an entire form, nor can you attach more than one note to a single field.

To add a note to a return, follow these steps:

- Click the field where you want to add the note.

- On the Return menu and click Preparer Notes.

- Click New.

![]()

- Type the notes you want to add to the return.

- Click Save.

![]()

How to manually add paid preparer information in the Paid Preparers Database in Simple Tax 1040

MORE INFORMATION

16 STEPS

1. Click Preparer

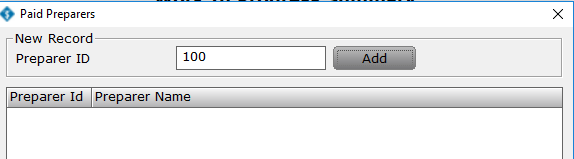

2. Enter a Preparer ID, that can be letters or numbers, click Add

3. Enter the Preparer Name

4. Enter the Preparer's PTIN

5. Enter the Firm's Name

6. Enter the Firm's Address

7. Enter the City

8. Enter the State

9. Enter the Zip Code

10. Select the Preparer Type

11. Enter the Office Phone Number

12. Enter your Cell Phone Number

13. Select the Cell Phone Carrier

14. Enter your Email

15. Click Save

16. Click Close

Here's an interactive tutorial

https://www.iorad.com/player/1691150/Software-Setup-Wizard-for-Preparer

The Paid Preparers database stores information tax return preparers. Simple Tax 1040 uses this information to populate the preparer information section of Form 1040 and the preparer information section of any state tax form.

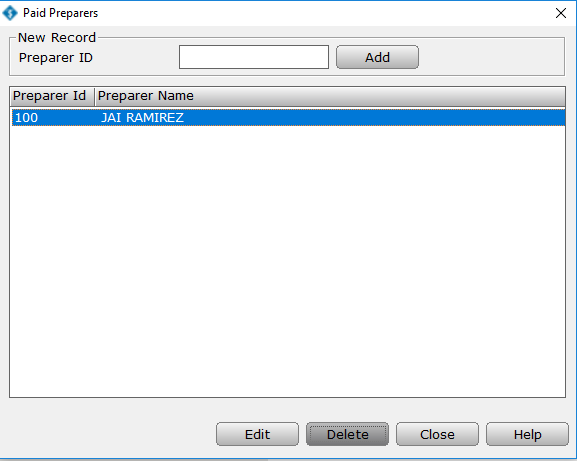

To ADD new information to the Paid Preparers Database, follow these steps:

- Click the Database menu and then click Paid Preparers.

- The Paid Preparers screen will display. Type the new preparer ID in the Preparer ID field and then click the Add button.

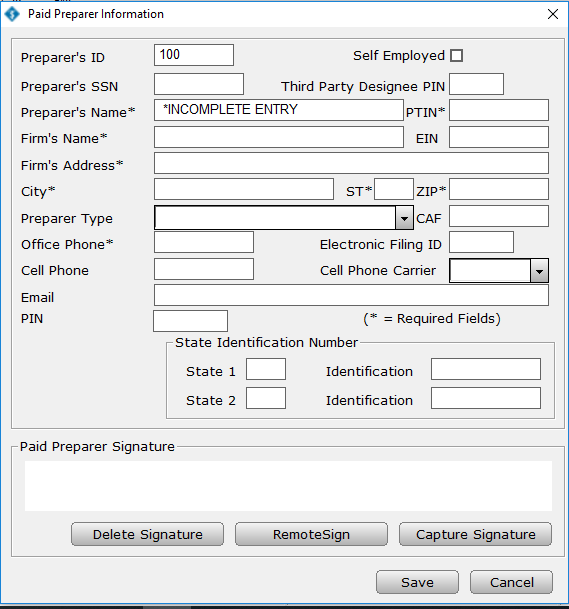

- The Paid Preparers Information window will open.

- Select the Self Employed option the preparer is self employed.

- In the Preparer’s SSN field, type the preparer’s Social Security Number. If using Simple Tax 1040 2011 or above, this field may not be available.

- In the PTIN field, type the preparer’s Personal Tax Identification Number. Information entered here will print on the bottom of Form 1040.

- Type the preparer’s name in the Preparer’s Name field.

- Type the firm’s Name, address, and office phone number in the appropriate fields.

- Type the preparer's cell phone in the Cell Phone field and then select the cell phone carrier from the Cell Phone Carrier drop box.

- Type the preparer’s e-mail address in the Email field.

- Click the Capture Signature button to capture the preparer’s signature with your signature pad or mouse.

- Click Remote Sign to sign remotely through cell phone or email, this will set the Remote Signature Feature.

- 13. Once you have completed entering information, click Save to add the information to the database.

To EDIT information in the Paid Preparers Database, follow these steps:

- Click the Database menu and then click Paid Preparers.

- The Paid Preparers screen will display. Under Preparer Name, click the employer you want to edit and then click Edit.

- Once you have finished editing the employer information, click Save.

To DELETE information stored in the Paid Preparers Database, follow these steps:

- Click the Database menu and then click Paid Preparers.

- The Paid Preparers screen will display. Under Preparer Name, click the employer you want to delete and then click Delete.

- Click Delete in the Database Delete window to confirm that you want to delete the employer.