Reporting Actual Vehicle Expenses in SCH C

Reporting Actual Expenses in SCH C

This article will show you how to report actual vehicle expenses in Schedule C that is not mileage.

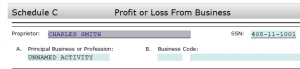

- After you add your SCH C

- Click Add Form

- Click on the last tab labelled Depreciation

- Click Car/Truck Vehicle Allocation

- Click New Asset

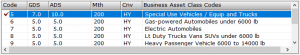

![]()

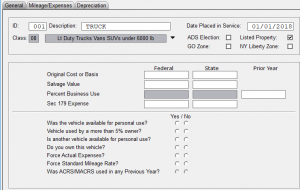

- Enter a description of the vehicle in the Description box and the Date Placed in Service

![]()

- Select the type of vehicle from the Business Asset Class Code

- Click OK

- Fill out the General tab with the information provided to you by the tax payer.

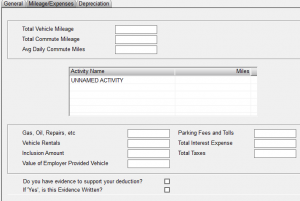

- Click on the Mileage/Expenses tab

- Enter a value of 1 in the Total Vehicle Mileage box

![]()

- Enter a value of 1 under Miles next to the Activity Name

![]()

- Now enter the expenses of Gas, Oil, Repairs, etc, Parking Fees and Tolls, Vehicle Rentals, Total Interest Expense, Inclusion Amount, Total Taxes, and Value of Employer Provided Vehicle with the information provided to you by the tax payer.

![]()

- Answer the following two questions "Do you have evidence to support your deduction?" and "If 'YES' is this Evidence Written?".

![]()

- Click CLOSE

- In the Special Depreciation Allowance screen click OK

- Click Return to List

- Click Close

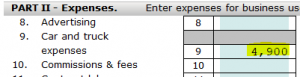

- Go to SCH C line 9 where you will see the total expenses you entered.

How to view a list of non-returning customers

How to view a list of non-returning customers

SUMMARY

This article demonstrates how to run a report of customers who have not returned to you for tax preparation services during the current tax year.

MORE INFORMATION

To view a list of non-returning customers, follow these steps:

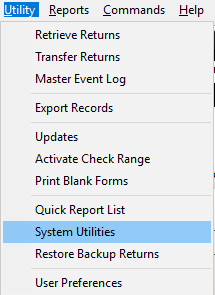

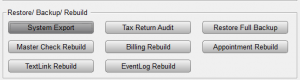

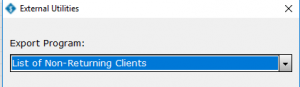

- On the Utilities menu, click System Utilities.

- Click System Export.

- Click Run Utility.

- In the Export Program box, List of Non-Returning Clients will be already selected, if not select it from the drop box.

- In the Output File Name box, type the location and name of the file where you want to save the client list. Specify .csv as the file name extension. Example: c:\non_returning_clients.csv

![]()

- Click Run. The software saves the list of customers to the folder file you specified. You can open the file in Microsoft Excel or any program capable of opening .csv files.

![]()

How to run the Rejected Returns Report

How to run the Rejected Returns Report

SUMMARY

This article provides information on the Rejected Returns Report.

MORE INFORMATION

The IRS Rejections Report displays a listing of returns rejected by the IRS.

How to view the Rejected Returns Report

To generate the Rejected Returns Report, follow these steps:

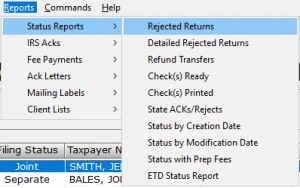

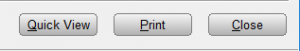

- On the Reports menu, point to Status Reports and then click Rejected Returns.

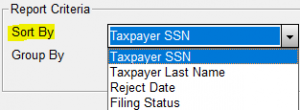

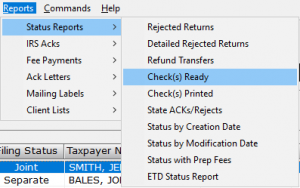

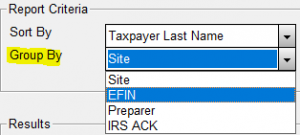

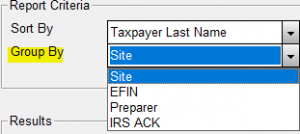

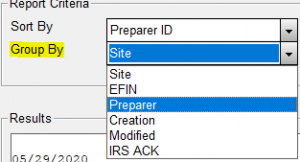

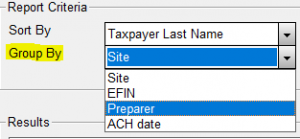

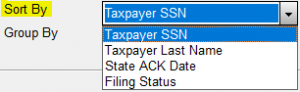

- In the Sort By list, choose the applicable sort option.

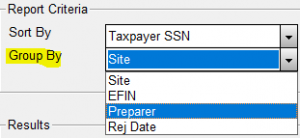

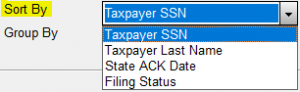

- In the Group By list, choose the applicable grouping option.

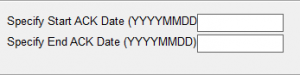

- In the Specify Starting ACK Date box, type the beginning acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

- In the Specify Ending ACK Date box, type the ending acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

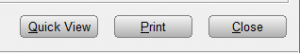

- Click Quick View and then click Print.

Report Fields

The following information is displayed on the Rejected Returns Report:

Report Field

Description

SSN

Social Security Number

Last Name

Taxpayer Last Name

Date

Date of IRS Rejection

EFIN

Electronic Filing Identification Number

Center

IRS Processing Centers

EF ST

State return designator

Reporting Options

You can use the following report options when generating the Rejected Returns Report.

Sorting Options

You can sort the Rejected Returns Report by the following fields:

- Taxpayer SSN

- Taxpayer Last Name

- Reject Date

- Filing Status

Grouping Options

You can group information in the Rejected Returns Report by the following:

- Site

- EFIN

- Preparer

- Rejection Date

How to run the Check(s) Ready Report

How to run the Check(s) Ready Report

SUMMARY

This article provides information on the Check(s) Ready Report.

MORE INFORMATION

This Report provides a list of clients whose checks are ready for printing. It allows you to sort and group the clients by different criteria and includes the client’s home phone number. This Report is a useful tool to use in tandem with check distribution.

How to view the Check(s) Ready Report

To generate the Check(s) Ready Report, follow these steps:

- On the Reports menu, point to Status Reports and then click Check(s) Ready.

- In the Sort By list, choose the applicable sort option.

- In the Group By list, choose the applicable grouping option.

- Click Quick View and then click Print.

Report Fields

The following information is displayed on the Rejected Returns Report:

Report Field

Description

SSN

Social Security Number

Last Name

Taxpayer Last Name

First Name

Taxpayer First Name

Home Phone

Taxpayers Home Phone Number

EFIN

Electronic Filing Identification Number

Rcpt#

Receipt Number

Reporting Options

You may use the following report options when generating the Check(s) Ready Report.

Sorting Options

You can sort the Check(s) Ready Report by the following fields:

- Taxpayer SSN

- Taxpayer Last Name

- Receipt Number

- Preparer EFIN

- Preparer Site

Grouping Options

You can group information in the Check(s) Ready Report by the following:

- Site

- EFIN

- Preparer

- IRS ACK

How to run the IRS Acknowledgement report

How to run the IRS Acknowledgement report

SUMMARY

This article provides information on the IRS and State Acknowledgements Report.

MORE INFORMATION

The IRS Acknowledgment Report lists federal and state returns acknowledged by the IRS or state tax authority.

How to view the IRS and State Acknowledgement Report

To generate the IRS and State Acknowledgements Report, follow these steps:

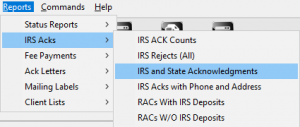

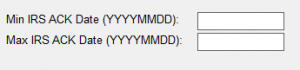

- On the Reports menu, point to IRS ACKs and then click IRS and State Acknowledgements.

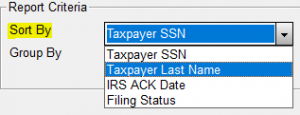

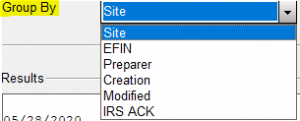

- In the Sort By list, choose the applicable sort option.

- In the Group By list, choose the applicable grouping option.

- In the Minimum and Maximum IRS ACK Date field, type the applicable dates in the MMDD format – for example, for January 1 type 0101.

- Click Quick View and then click Print.

![]()

Report Fields

The following information is displayed on the IRS and State Acknowledgements Report:

Report Field

Description

Site

Site Identification Number

Preps Code

Paid Preparer’s Identification Number

SSN

Social Security Number

Last Name

Taxpayer Last Name

First Name

Taxpayer First Name

Ack Date

IRS Acknowledgement Date

Status

Current Status of Return

Refund

Refund Amount

Rfd Type

Refund Type Designator

EFIN

Electronic Filing Identification Number

State ID

First State Designator

Reporting Options

You can use the following report options when generating the IRS and State Acknowledgements Report.

Sorting Options

You can sort the IRS and State Acknowledgements Report by the following fields:

- IRS DCN

- Taxpayer SSN

- Taxpayer Last Name

- IRS ACK Date

Grouping Options

You can group information in the IRS and State Acknowledgements Report by the following:

- Site

- EFIN

- Preparer

- IRS ACK

How to run the IRS ACK Counts report

How to run the IRS ACK Counts report

SUMMARY

This article provides information on the IRS ACK Counts Report.

MORE INFORMATION

This Report provides a list of all federal returns acknowledged within a date range you specify.

How to view the IRS ACK Counts Report

To generate the IRS ACK Counts Report, follow these steps:

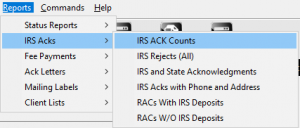

- On the Reports menu, point to IRS ACKs and then click IRS ACKs Counts.

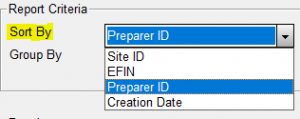

- In the Sort By list, choose the applicable sort option.

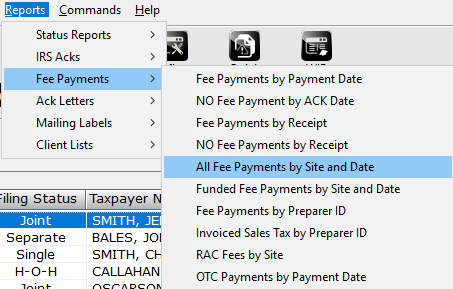

- In the Group By list, choose the applicable grouping option.

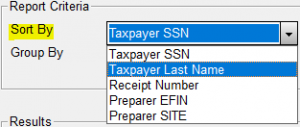

- In the Starting and Ending ACK Date fields, type the applicable dates in the MMDD format – for example, for January 1 type 0101.

- Click Quick View and then click Print.

![]()

Report Fields

The following information is displayed on the IRS ACK Counts Report:

Report Field

Description

Site

The Site ID that created the tax return

EFIN

The electronic filing identification number assigned to the tax return.

Preps Code

The shortcut ID of the preparer that prepared the tax return.

Created

The date the preparer created the tax return.

Modified

The date a user last modified the tax return.

Reporting Options

You can use the following report options when generating the IRS ACK Counts Report.

Sorting Options

You can sort the IRS ACK Counts Report by the following fields:

- Site ID

- EFIN

- Preparer ID

- Creation Date

Grouping Options

You can group information in the IRS ACK Counts Report by the following:

- Site

- EFIN

- Preparer

- Creation

- Modified

- IRS ACK

How to run the Fee Payment by Site and Date report

How to run the Fee Payment by Site and Date report

SUMMARY

This article provides information on the Fee Payment by Site and Date Report.

MORE INFORMATION

This Report provides a list of Returns by Site for which the fees have been paid. Simple Tax 1040 sorts this report by payment date

How to view the Fee Payments by Site and Date Report

To generate the Fee Payment by Site and Date Report, follow these steps:

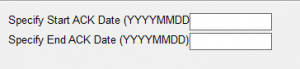

- On the Reports menu, point to Fee Payments and then click Fee Payment by Site and Date.

- In the Sort By list, choose the applicable sort option.

- In the Group By list, choose the applicable grouping option.

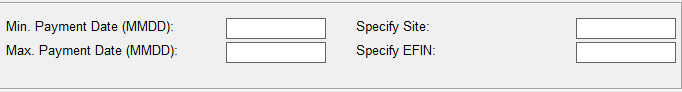

- In the Minimum and Maximum Payment Date field, type the applicable dates in the MMDD format – for example, for January 1 type 0101.

- In the Specify Site field, type the applicable site identification number.

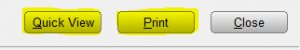

- Click Quick View and then click Print.

How To Create Custom Reports in SimpleTAX 1040

How to create custom reports in SimpleTAX 1040

SUMMARY

This article demonstrates how to create custom reports in SimpleTAX 1040

MORE INFORMATION

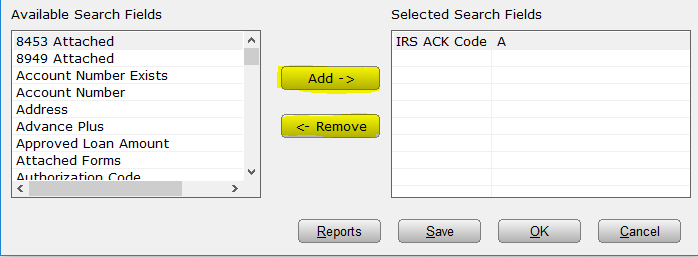

To create a custom report, follow these steps:

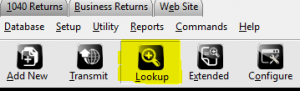

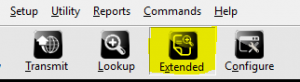

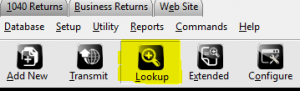

- From the WIP, click Lookup.

- Click Extended

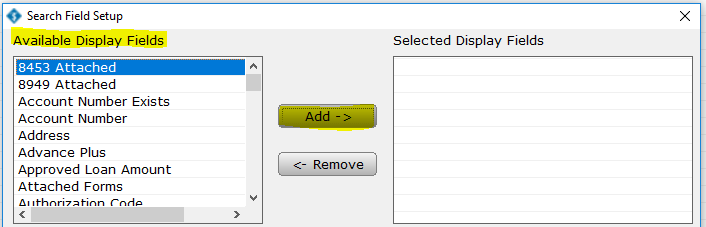

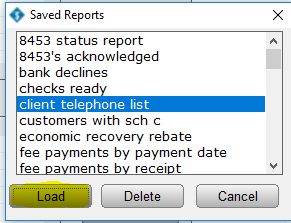

- Under Available Display Fields, select the fields you want to see in the report, then click Add

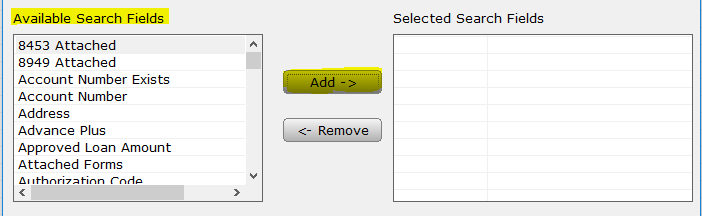

- Under Available Search Fields, select the fields you want to search by in the report, then click Add

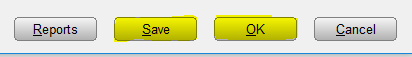

- To save the report for future use, click Save. To run the report, Click OK.

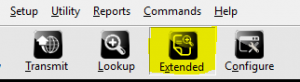

To modify an existing, follow these steps:

- From the WIP, click Lookup.

- Click Extended

- Click Reports.

- Select the report you want to modify and then click Load.

- Under Available Display Fields, select the fields you want to see in the report, then click Add or under the Selected Display Fields select the field you want to remove in the report, then click Remove.

- Under Available Search Fields, select the fields you want to search by in the report, then click Add or under the Selected Search Fields select the field you want to remove in the report, then click Remove.

- To save the report for future use, click Save. To run the report, Click OK.

How to run the State ACKs/Rejects Report

How to run the State ACKs/Rejects Report

SUMMARY

This article provides information on the State ACKs/Rejects Report

MORE INFORMATION

This Report provides a list of state returns that have been acknowledged by the state tax authority.

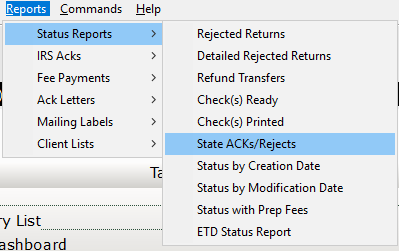

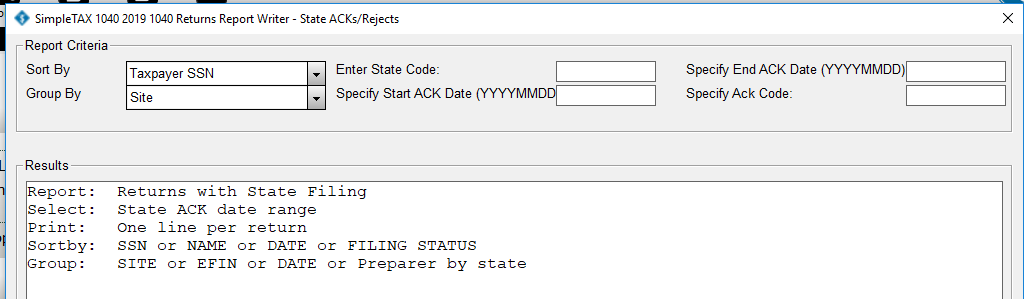

To generate the State ACKs/Rejects Report, follow these steps:

- On the Reports menu, point to Status Reports and click State ACKs/Rejects.

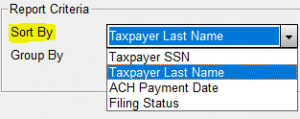

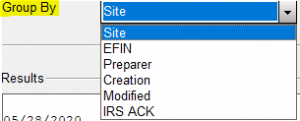

- In the Sort By list, choose the applicable sort option.

- In the Group By list, choose the applicable grouping option.

- In the Enter State Code box, type the State Code if you have one.

- In the Specify Starting ACK Date box, type the beginning acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

- In the Specify Ending ACK Date box, type the ending acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

- In the Specify Ack Code box, enter and Ack Code if you have one.

- Click Quick View and then click Print.

![]()

Report Fields

The following information is displayed on the State ACKs/Rejects Report

Report Field

Description

EFIN

Electronic Filing Identification Number

Site

Originating site number

SSN

Social Security Number

FLST

Filing Status

Last Name

Taxpayer Last Name

First Name

Taxpayer First Name

State

State Designator

Acked

Return has been Acknowledge

Acked Date

Date the return was Acknowledged

Recv Date

Date the return was received at IRS

Mailed Date

Date Return was Mailed

Refund

Refund Amount

BDUE

Balance Due

Reporting Options

You can use the following report options when generating the State ACKs/Rejects Report.

Sorting Options

You can sort the State ACKs/Rejects Report by the following fields:

- Taxpayer SSN

- Taxpayer Last Name

- State ACK Date

- Filing Status

Grouping Options

You can group information in the State ACKs/Rejects Report by the following:

- Site

- EFIN

- Preparer

- Creation

- Modified

- IRS ACK