How Can We Help?

How to run the IRS Acknowledgement report

How to run the IRS Acknowledgement report

SUMMARY

This article provides information on the IRS and State Acknowledgements Report.

MORE INFORMATION

The IRS Acknowledgment Report lists federal and state returns acknowledged by the IRS or state tax authority.

How to view the IRS and State Acknowledgement Report

To generate the IRS and State Acknowledgements Report, follow these steps:

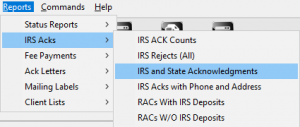

- On the Reports menu, point to IRS ACKs and then click IRS and State Acknowledgements.

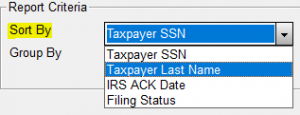

- In the Sort By list, choose the applicable sort option.

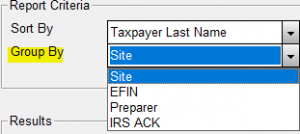

- In the Group By list, choose the applicable grouping option.

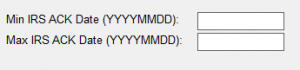

- In the Minimum and Maximum IRS ACK Date field, type the applicable dates in the MMDD format – for example, for January 1 type 0101.

- Click Quick View and then click Print.

![]()

Report Fields

The following information is displayed on the IRS and State Acknowledgements Report:

Report Field

Description

Site

Site Identification Number

Preps Code

Paid Preparer’s Identification Number

SSN

Social Security Number

Last Name

Taxpayer Last Name

First Name

Taxpayer First Name

Ack Date

IRS Acknowledgement Date

Status

Current Status of Return

Refund

Refund Amount

Rfd Type

Refund Type Designator

EFIN

Electronic Filing Identification Number

State ID

First State Designator

Reporting Options

You can use the following report options when generating the IRS and State Acknowledgements Report.

Sorting Options

You can sort the IRS and State Acknowledgements Report by the following fields:

- IRS DCN

- Taxpayer SSN

- Taxpayer Last Name

- IRS ACK Date

Grouping Options

You can group information in the IRS and State Acknowledgements Report by the following:

- Site

- EFIN

- Preparer

- IRS ACK