How to transfer a single return to another computer

How to transfer a single return to another computer

SUMMARY

This article demonstrates how to transfer a tax return to another computer.

MORE INFORMATION

Use Transfer Return to copy a tax return to a new computer. When you transfer a tax return, you back up a copy of the tax return and restore it on another computer. To transfer the return, you’ll need to have access to portable media.

Step 1: Back up the return.

To back up a tax return, follow these steps:

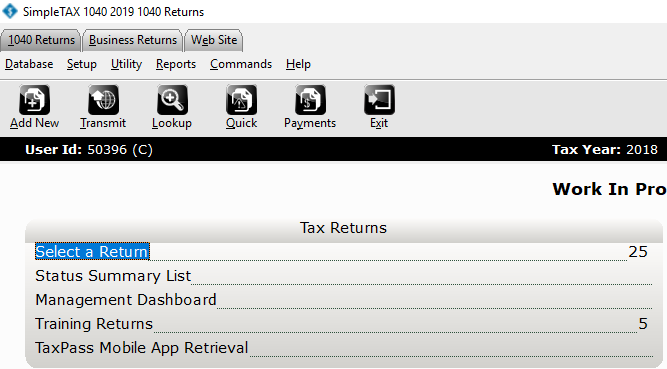

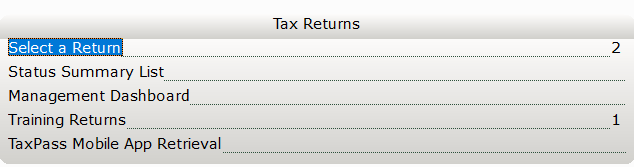

- From the Work In Progress screen, click Select a Return.

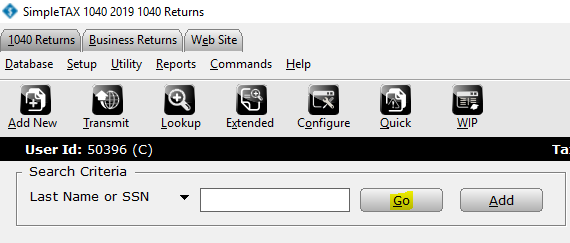

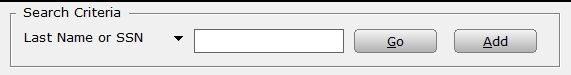

- In the Last Name or SSN box, type the Social Security Number of the tax return you want to transfer and then click Go.

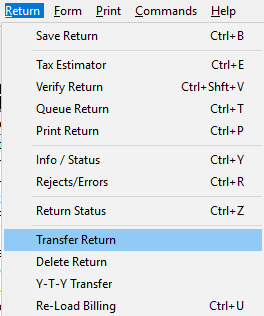

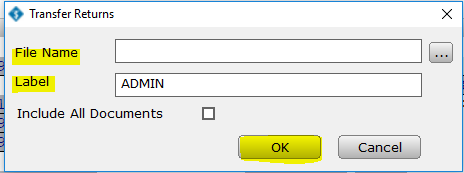

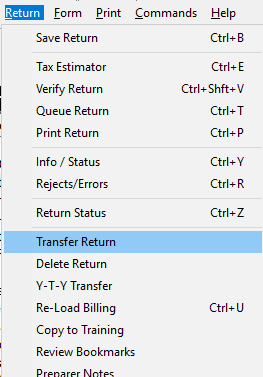

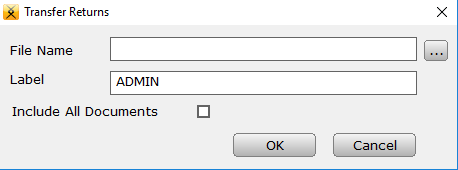

- On the Return menu, click Transfer Return. The Transfer Returns dialog appears.

- In the File Name box, type the folder where you want to save the save the tax return file. Example: x:\filename.xf9

- In the Label box, type a description for the tax return.

- Click OK and SimpleTAX 1040 copies the tax return to the location you selected.

Step 2: Restore the return

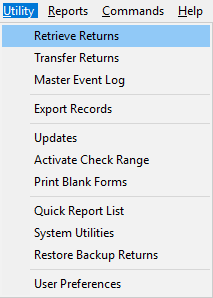

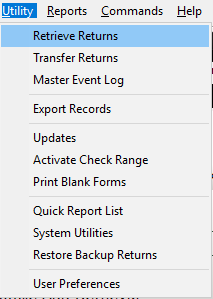

- On the Utility menu in SimpleTAX 1040, click Retrieve Returns.

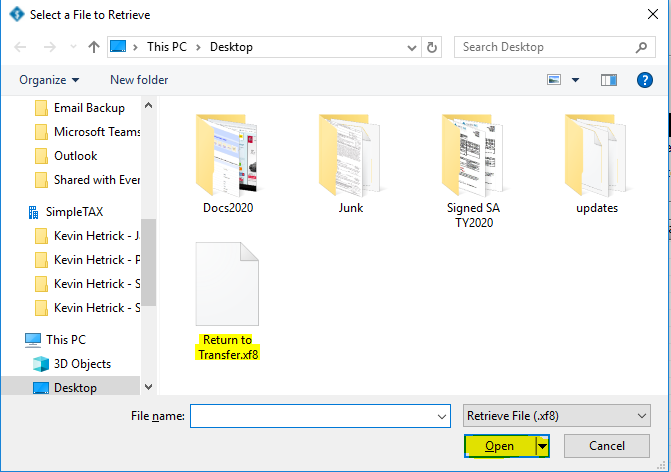

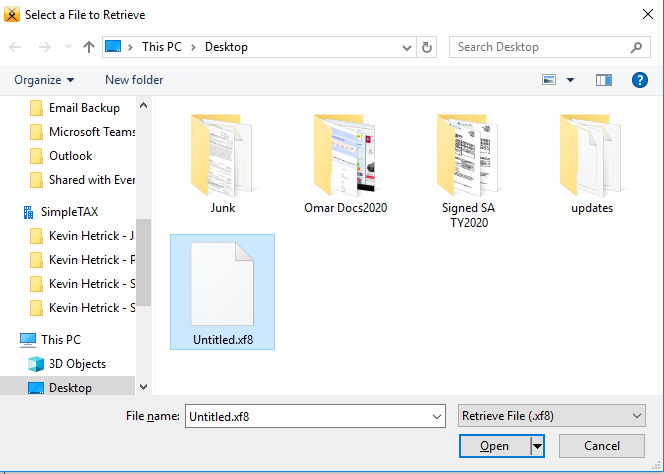

- In the Select a File to Retrieve dialog, browse to the folder where you saved the backed up tax return. Select the return and c;lick OPEN.

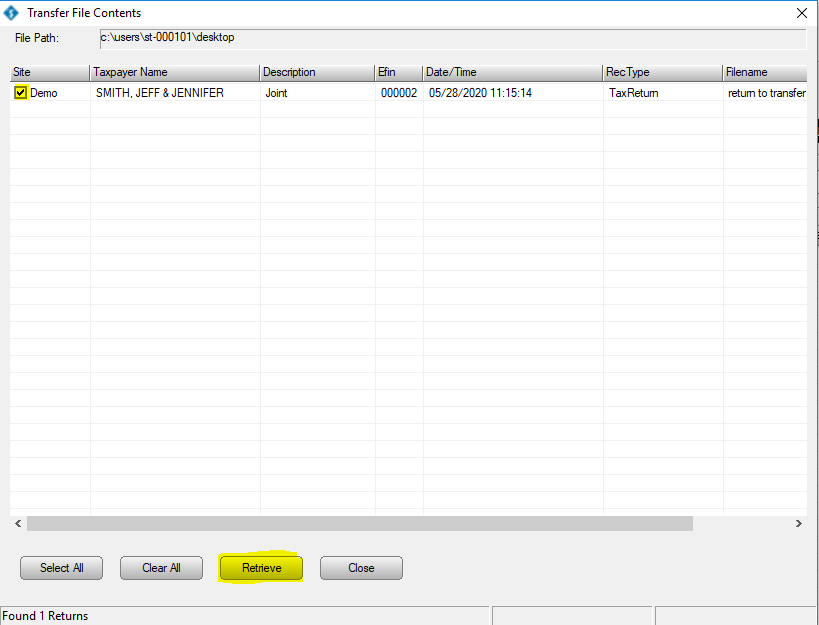

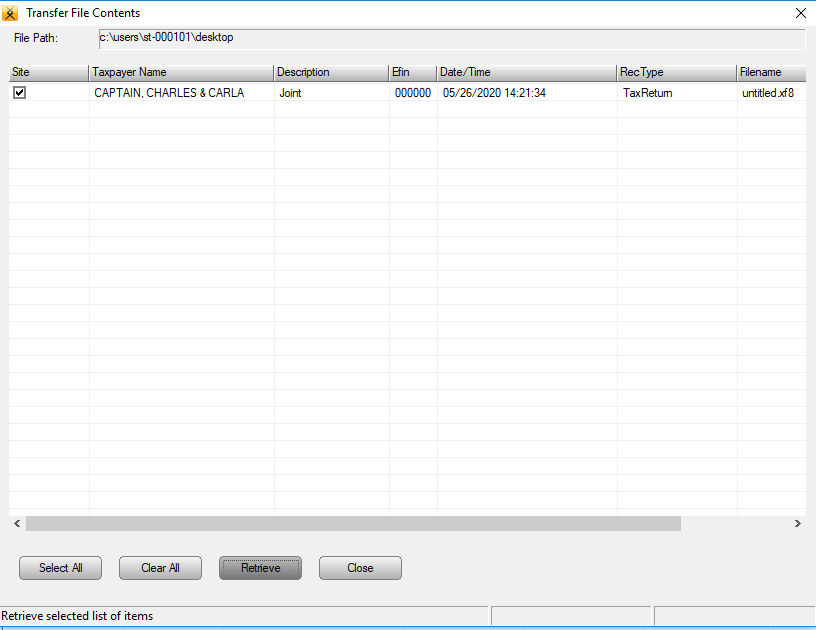

- In the Transfer File Contents dialog, select the check box in the Site column for the return you want to open and then click Retrieve. The return now appears in the Lookup screen. Double-click the return you want to open.

“Return locked by service bureau” Refusal message when transmitting a tax return

“Return locked by service bureau” error message when transmitting a tax return

SYMPTOMS

When a subsite of a service bureau tries to transmit a tax return, the following rejection appears:

‘Return locked by service bureau’

CAUSE

This behavior occurs of the ownership of the return is set to service bureau.

RESOLUTION

Sub-site Steps

To resolve this issue, the sub-site will need to contact the service bureau to have the return unlocked.

Service Bureau Steps

To unlock the return, do the following at the service bureau main site:

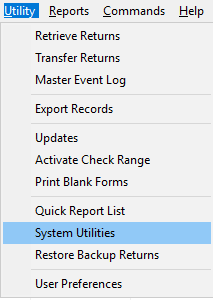

- On the Utility menu, click Unlock Tax Return.

- Type the applicable Social Security number and then click Unlock. Simple Tax 1040 transmits to the central site to unlock a return.

How to restore a deleted tax return

How to restore a deleted tax return

SUMMARY

This article demonstrates how to restore a deleted tax return in Simple Tax 1040.

MORE INFORMATION

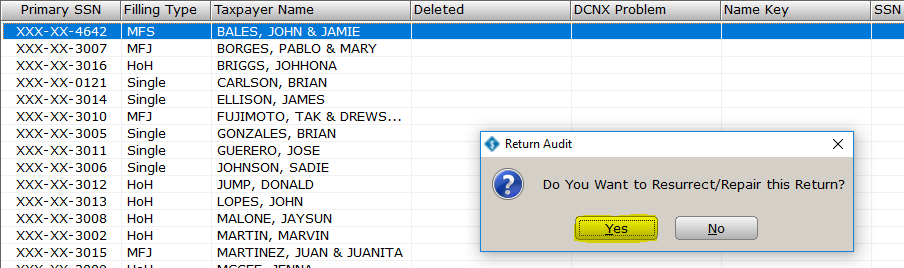

To restore deleted tax returns, follow these steps:

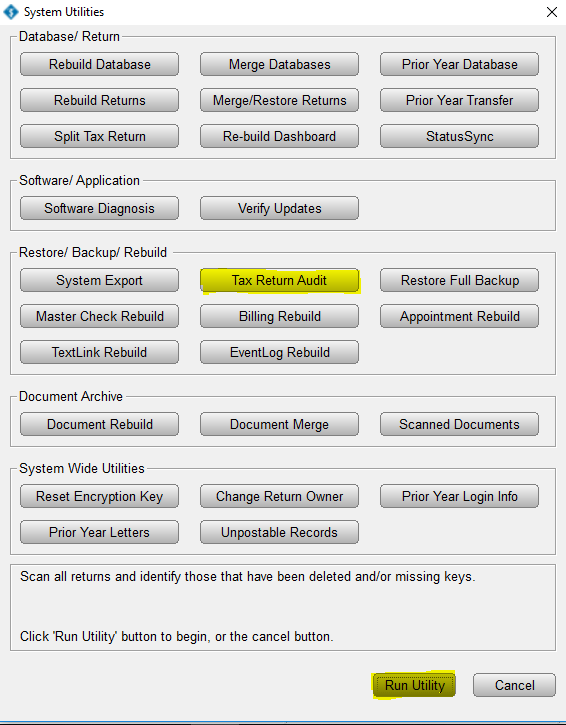

- On the Utility menu, click System Utilities.

- Click Tax Return Audit and then click Run Utility.

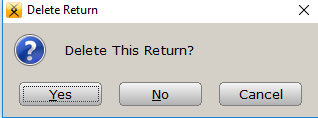

- Click the deleted return you want to restore, and in the Deleted Return dialog, click Yes.

How to delete a tax return

How to delete a tax return

SUMMARY

This article demonstrates how to delete a tax return in Simple Tax 1040.

MORE INFORMATION

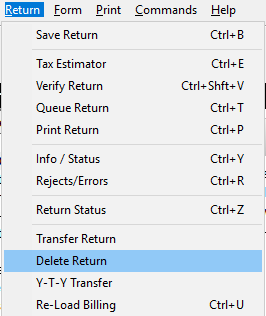

To delete a tax return in Simple Tax 1040, follow these steps:

- Open the tax return you want to delete.

- Remove all Social Security Numbers from the return. (Including Tax Payer, Spouse, and any Dependents)

- On the Return menu, click Delete Return.

- In the Delete Return dialog appears, click Yes.

Note: Simple Tax 1040 does not provide support for deleting multiple tax returns at the same time. You must delete each tax return individually.

How to back up a single return in Simple Tax 1040

How to back up a single return in Simple Tax 1040

SUMMARY

This article demonstrates how to back up a single tax return and restore it on another computer.

MORE INFORMATION

Use Transfer Return to copy a tax return to a new computer. When you transfer a tax return, you back up a copy of the tax return and restore it on another computer. To transfer the return, you’ll need to have access to portable media. There are many types of portable media: you can use CD-R, DVD-R, Zip drives, Jazz drives, tape drives and more. Be sure to choose the right one based on how much information you want to save.

Step 1: Back up the return.

To back up a tax return, follow these steps:

- From the Work In Progress screen, click Select a Return.

- In the Last Name or SSN box, type the Social Security Number of the tax return you want to transfer and then click Go.

- On the Return menu, click Transfer Return. The Transfer Returns dialog appears.

- In the File Name box, type the folder where you want to save the save the tax return file.

- In the Label box, type a description for the tax return.

- Click OK and Simple Tax 1040 copies the tax return to the location you selected.

Step 2: Restore the return

- On the Utility menu in Simple Tax 1040, click Retrieve Returns.

- In the Select a File to Retrieve dialog, browse to the folder where you saved the backed up tax return.

- In the Transfer File Contents dialog, select the check box in the Site column for the return you want to open and then click Retrieve. The return now appears in the Lookup screen. Double-click the return you want to open.

How to enter the standard mileage rate in a business tax return

How to enter the standard mileage rate in a business tax return

SYMPTOMS

You are unable to enter a vehicle with the standard mileage rate in a business tax return or you cannot find where to enter the standard mileage.

CAUSE

The standard mileage rate is only allowed for self-employed individuals or employees. Partnerships and corporations cannot use the standard mileage rate. See IRS Notice 19-05

RESOLUTION

For a business tax return, you’ll need to use the actual expense method.

How to print a tax return

How to print a tax return

To print a tax return, follow these steps:

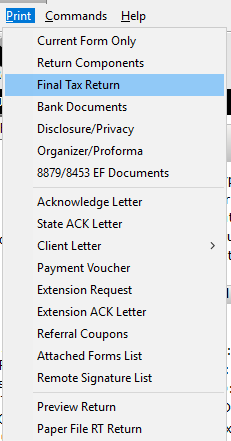

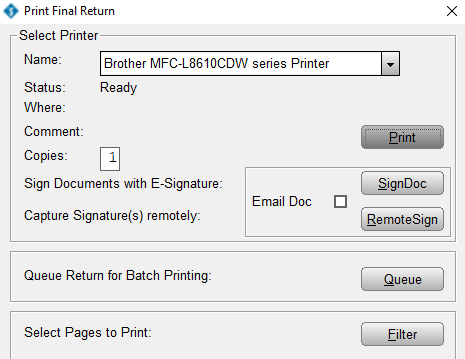

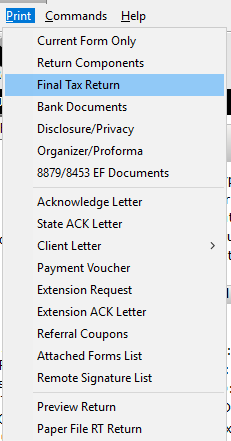

- From within a tax return, on the Print menu, click Final Tax Return.

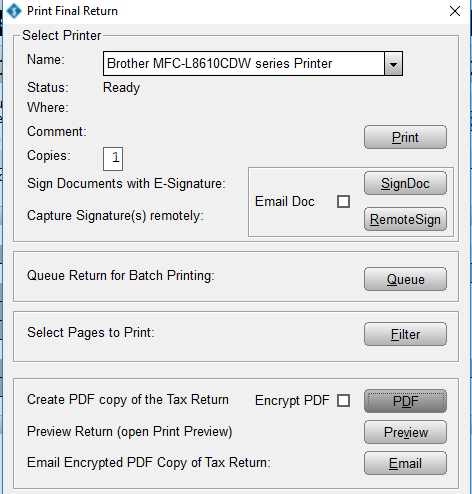

- Click the Print button.

How to print the current form or worksheet

To print the current form or worksheet, follow these steps:

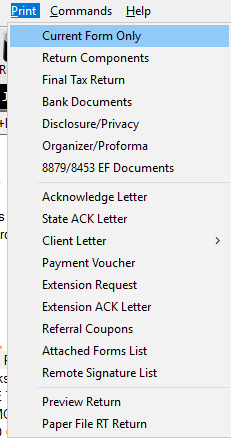

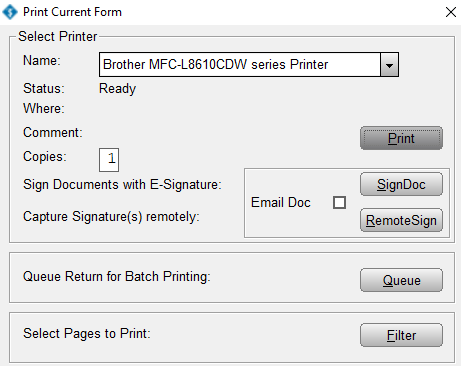

- Go to the form or worksheet you want print within a tax return

- Click the Print menu, click Print Current Form.

- Click the Print button.

How to print a tax return as a PDF

How to print a tax return as a .pdf document

To print a tax return as a PDF document in Simple TAX 1040, follow these steps:

- From within a tax return, click Final Tax Return on the Print menu.

- Click PDF.

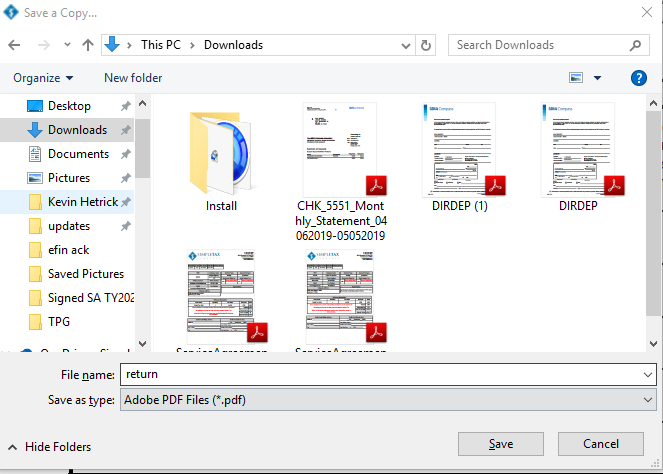

- In the .pdf file, click the Save Icon .

- In the Save As Copy dialog, browse to the folder where you want to save the .pdf file and then click Save.